It’s earnings season on Wall Street. Many US firms have produced financial statements over the last month or so. It was also a busy month for director dealings. Directors at Merck & Co, JP Morgan and Goldman Sachs sold shares just as interim statements were published. Directors at other blue chips, including Coca Cola, purchased shares in the company they manage. Directors are not required to disclose why they bought or sold, but perhaps we can review these companies’ interim results to gauge whether directors are likely to be optimistic, or pessimistic, about the future. Let’s take a look at Merck & Co, the pharmaceutical and healthcare giant…

Are Directors Cashing in on Merck’s Success?

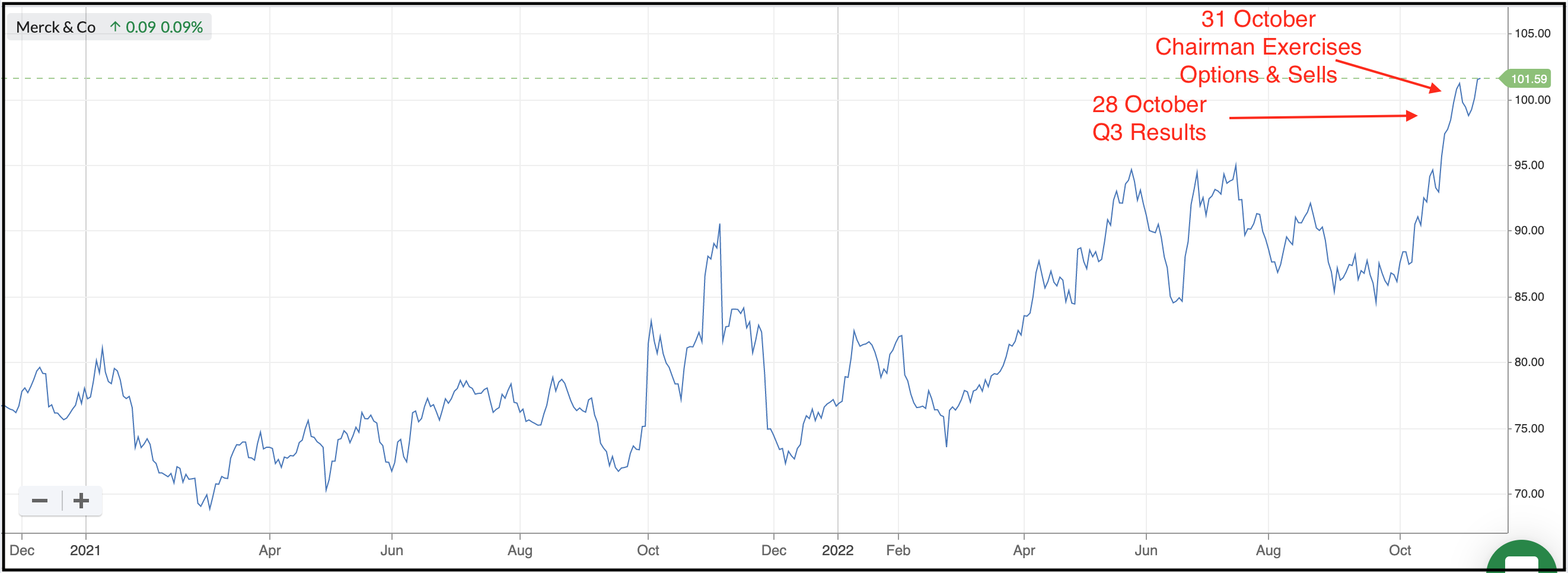

On October 28, Merck & Co reported higher-than-expected Q3 sales and profits. The firm benefited from a jump in demand for vaccines and cancer immunotherapy. Furthermore, some analysts believe that as the pandemic recedes, increased use of hospitals would support Merck’s doctor-office-focused drug portfolio. The positive Q3 results helped the share price reach $100, the highest point it reached over the preceding 52-week period. Directors were presented with opportunities to cash in on the price momentum. On 31 October, the firm’s Chairman, Kenneth C. Frazier used options to purchase 867,084 shares at $57.04, which he then sold at $100.44 per share, netting him a profit of $37m. The table below shows other trades that were made by directors exercising option schemes (see EX in Type column).

Director Selling At Investment Banks

JP Morgan saw a string of director sells in October. So too did Goldman Sachs, where CEO David Solomon sold $2.5m of shares on 28 October. Many of these transactions were linked to options (see below) but we should not overlook the possibility that the sales reflect a lack of optimism about the future. On the one hand, higher interest rates could generate higher profits as banks earn more in terms of net interest income. However, these gains could be offset by a slowdown in investment banking activity. Indeed, JP Morgan reported a slide in net income, as investment banking activity fell against the backdrop of ongoing market volatility. Third-quarter profits dropped by $9.74bn. This was not as steep as some analysts expected, but a 17% fall nevertheless. Profits were also down at Goldman Sachs. Quarterly results, released on 14 October, revealed…