I invested in a small way in this Shipping Company in 2022, principally because it provides diversification to my portfolio. (trading in dollars and in the shipping business)

Since investing I have sees a drop in the share price but also have received a couple of fat quarterly dividends. The Board has advised its plan to continue with its dividend policy. The yield is currently around 6-7% based on the current share price, and is covered by rental income.

The Company owns a fleet of so called "Handy" vessels which for which receive income from folks who contract for periods at an agreed daily rate. The US dollar is used as the currency of choice and the ships travel worldwide as the renters win contracts for shippping of goods. The rental price has recently declined, but the Directors expect this situation will change in the next 12 months to TMI's advantage.

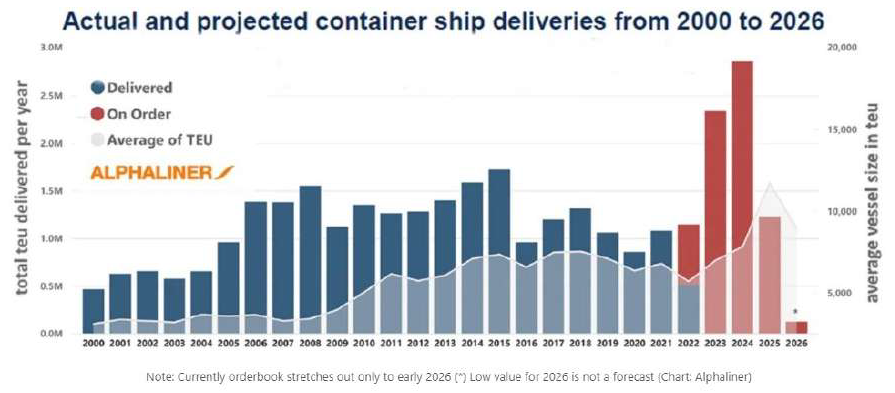

Freight rates are volatile. The Directors beleive that because there is little "Handy" shipbuilding currently scheduled, the rental rates will escalate due to a market which needs supply of flexible but relatively small vessels which can operate in ports which bigger boats cannot be used and the fact that Handy Vessels are not currently being built as ship yards worldwide are contracted to build other vessels.

There is also the opportunity for the Directors to deal in the trade of Handy ships. They have recently received an insurance settlement based on a ship which is stranded due to the war between Russia and Ukraine and announced they expect to sell a few second hand ships as well.

The Company, having bought out a competitor, Grindrog Shipping, increasing its debt to accomplish this transaction, has a major position in the Handy ships market. The Directors are expecting the rental income to increase as a result of growth in the daily rental rate over the next year or so due to the fact that there is currently no supply of new Handy ships, as ship builders are producing other types of vessel and demand for Handy ships will therfore rise as older Hany boats are decomissioned.

The Company has advised its intention to continue to provide investors with a solid regular quarterly income payable from rental income, whilst also paying down its debt by the middle of 2023. Assuming both these things are achieved the value of the…