Dividend Investments: Brookfield Global listed Infrastructure Income Fund Offers Elevated Return Potential

Stock markets continue to trade near all-time highs, as both the S&P 500 and NASDAQ have posted recent records in their underlying valuations. For investors, this can complicate the task of identifying inexpensive asset opportunities. But one sector that should be considered by value-oriented investors is in closed-end funds, which often trade at attractive discounts relative to net asset value. Additionally, closed-end funds tend to offer excellent income opportunities for investors seeking reliable dividend payouts.

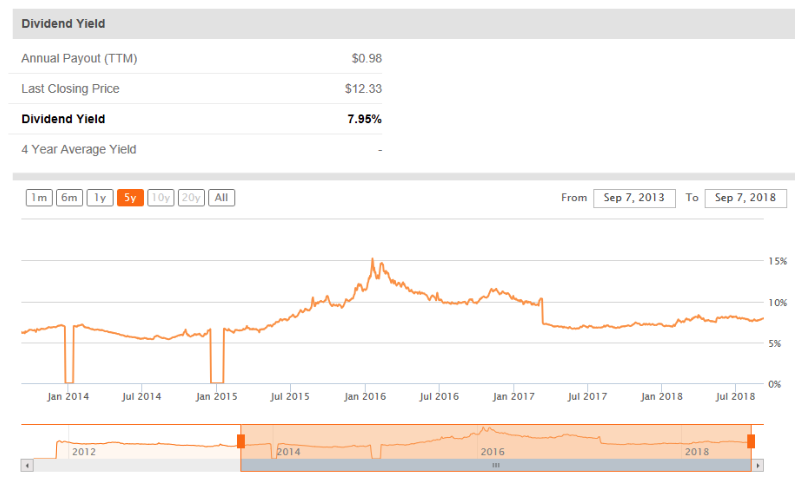

Dividend stock strategies work well in low-interest rate environments, so when investors are able to combine closed-end fund opportunities with strong income payers it becomes possible to identify the most ideal profitability scenarios in the financial markets. The Brookfield Global Listed Infrastructure Income Fund Inc. (the “Fund”) (NYSE:INF) offers one such opportunity, with its annualized dividend payout of $0.98 per share (which is paid monthly). This equates to a 7.95% distribution yield, which is far above the 1.76% dividend yield that is currently generated by the S&P 500.

The Fund has rallied over the last six months. The Fund’s current largest 10 holdings are an indicator of the overall positioning and asset allocation.

Looking more deeply into the Fund, we can see that as of June 30, 2018, 99% of its managed assets were in publicly-traded equity securities of infrastructure companies. As of July 31, 2018, the Fund has $202.81 million in assets under management (AUM). Recent rallies in share prices have been built on prior earnings progress from these companies, with broader valuations moving steadily higher since the beginning of 2016. In addition, market concerns regarding interest rate increases and inflation have somewhat subsided.

Market Outlook: Trade Tariffs and Monetary Policy

Most of the market has experienced some level of volatility and turmoil as the impact of political upheavals and heightened tariff discussions has made its influence felt. We are still seeing escalating trade tensions between US, China, and the Eurozone – and this has had a ripple effect on stock exchanges around the world. Moreover, these bearish moves can be attributed to the panic felt by investors relating to potential interest rate increases at the Federal Reserve.

This activity…