Beverage producer stocks have long been favourites with investors seeking reliable, defensive performers. And with good reason.

Many of these companies have enduring brands that deliver high margins and steady growth, year after year. Put simply, the economics of this business can be wonderful.

However, these shares have often looked quite pricey to me in recent years. And the last decade hasn’t exactly been a period of roaring demand growth for UK-focused producers, either.

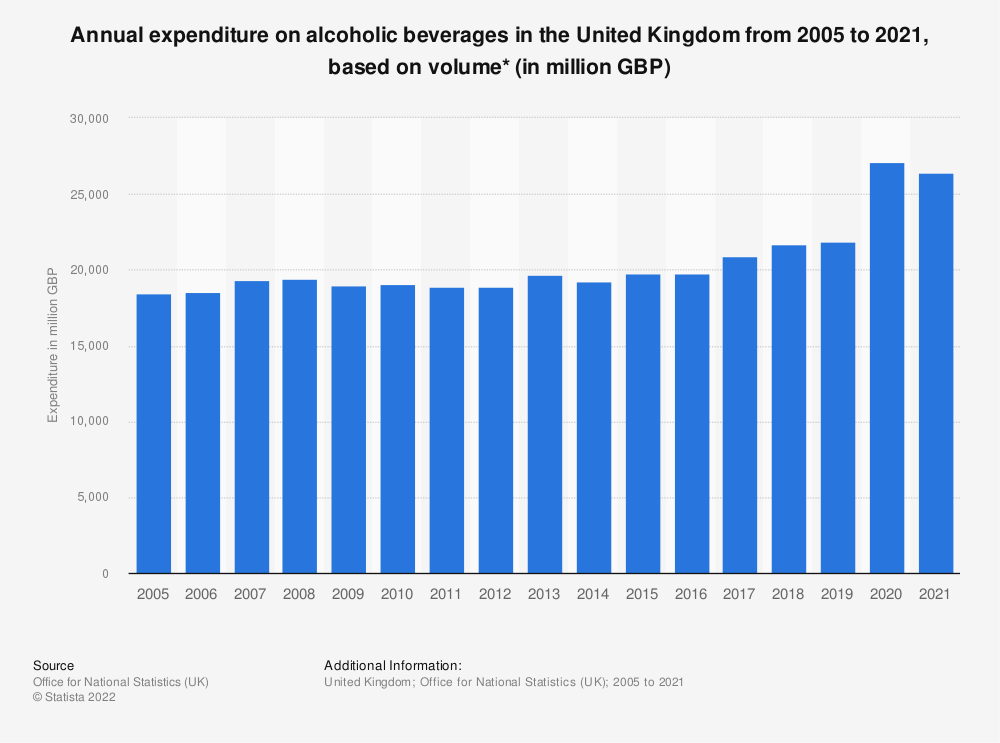

Spending on alcoholic drinks only rose by an average of 1.8% per year in the UK between 2013 and 2019, according to ONS data. The pandemic provided a boost, but this already appeared to be tailing off in 2021:

Source: Statista

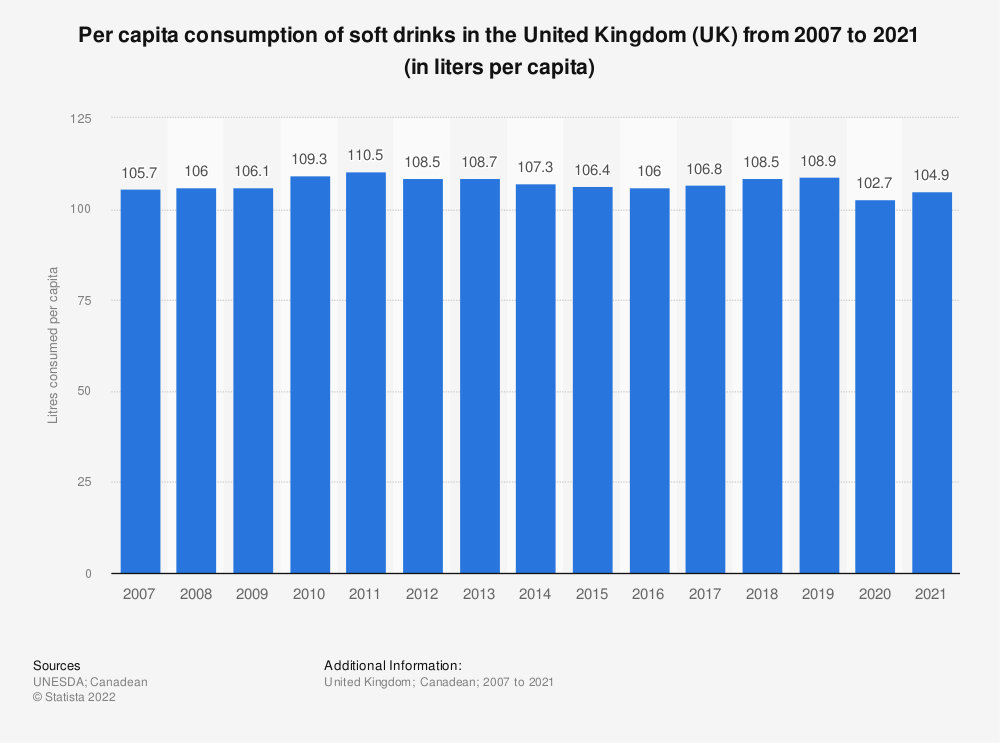

It was a similar story with soft drinks. Annual consumption per person in the UK appears to have peaked at 110.5 litres in 2011, and had fallen to 104.9 litres per person by 2021:

Source: Statista

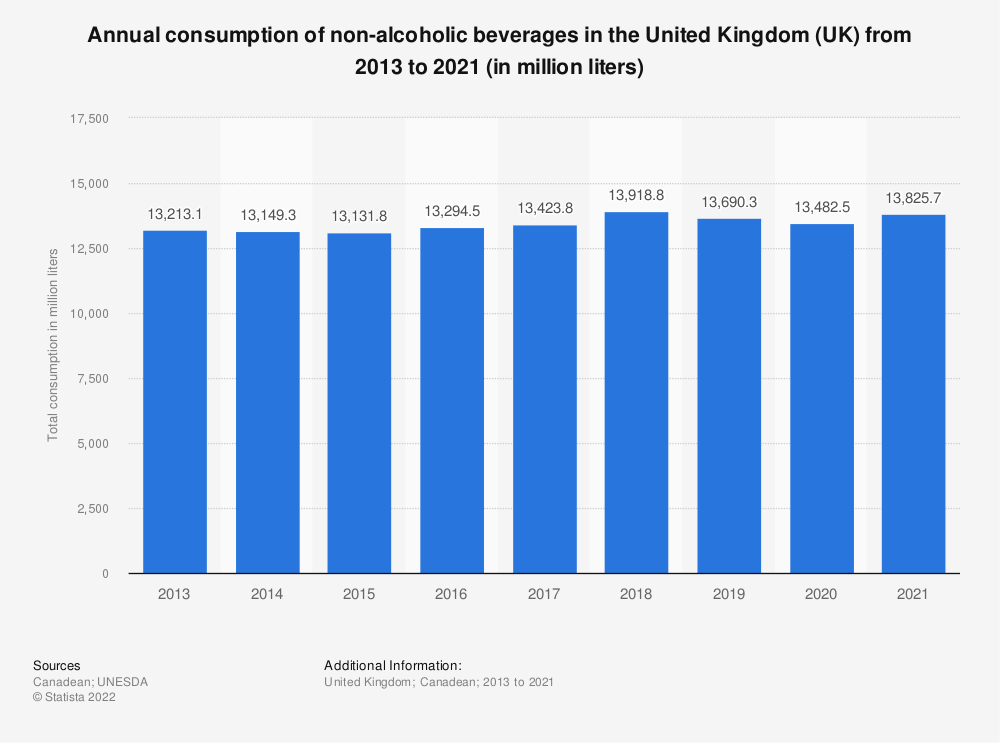

As a result, the total volume of non-alcoholic drinks sold in the UK rose by just 0.5% per year between 2013 and 2021:

Souce: Statista

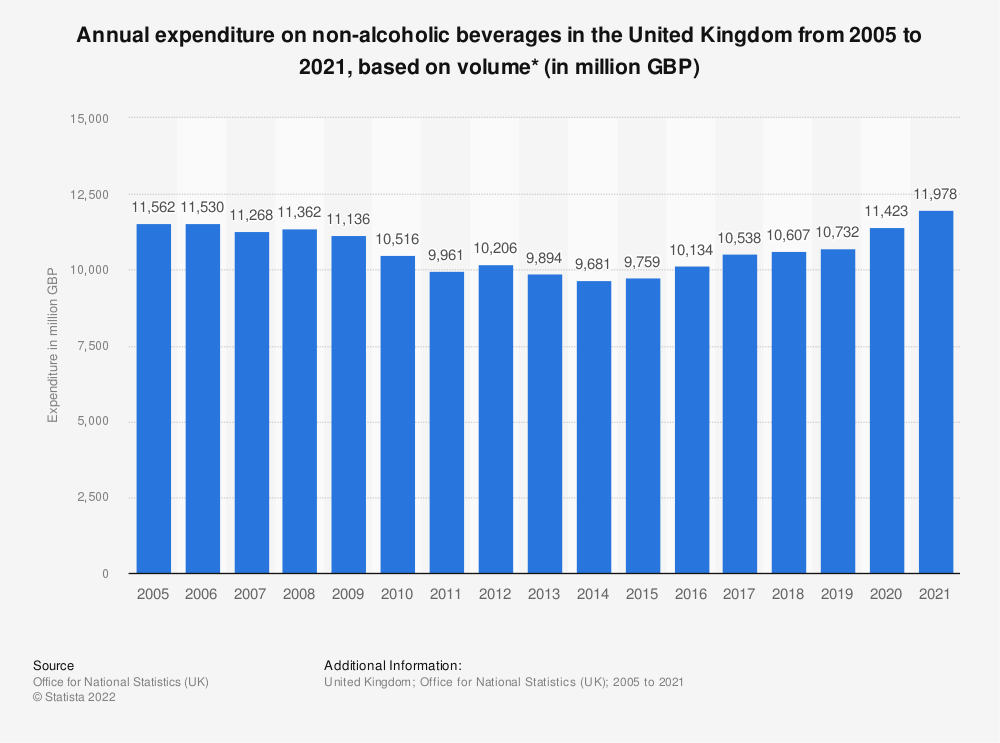

Spending on non-alcoholic drinks was also pretty flat too, rising by an average of just 1.9% each year between 2011 and 2021:

Source: Statista

Company results lack fizz: this lacklustre growth has been reflected in limited revenue and profit growth at many of the London market’s top beverage producers over the last decade, according to Stockopedia data:

Company | Revenue CAGR 2013-22 | Op. profit CAGR 2013-22 |

Diageo (LON:DGE) | 4.6% | 3.8% |

Coca Cola HBC AG (LON:CCH) | 3.3% | 7.4% |

Britvic (LON:BVIC) | 2.3% | 6.5% |

Fevertree Drinks (LON:FEVR) | 36.7%* | 31.0%* |

C&C (LON:CCR) | 13%** | -7.7% |

A G Barr (LON:BAG) | 2.5% | 3.1% |

Nichols (LON:NICL) | 5.0% | -3.6% |

*Obviously Fevertree was in growth mode for much of this period – but profits have halved since 2019.

**C&C acquired UK distributor Matthew Clark in 2018, boosting revenue, but not margins.

It may not seem very exciting, but what these numbers tell me is that during a period of low inflation and modest global…