The collapse of US tech lender Silicon Valley Bank -- SVB Financial (NSQ:SIVB) -- has triggered a sell-off in banking shares across the market. Despite this unfortunate event, an evenly-weighted basket of FTSE 100 bank shares would still have beaten the index by almost 10% over the last year.

Indeed, until recently, rising interest rates seemed to have signalled the end of a decade-long period of low profitability and shareholder scepticism:

FTSE 100 (grey) vs a simulated portfolio (blue) containing HSBA, BARC, STAN, LLOY & NWG

Given that the SVB failure is currently the big story in banking, I’ve added a short comment on this situation here.

–

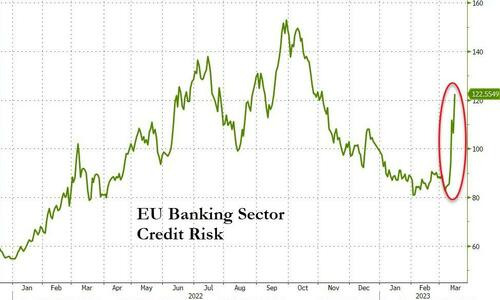

Are other banks at risk? SVB’s failure appears to have resulted from the bank’s decision not to hedge its interest rate risk. As a result, the bank suffered an unaffordable $1.8bn loss when it sold $21bn of long-term assets to fund surging customer withdrawals.

In effect, SVB’s management appears to have been betting that rates would stay low. Not a great idea.

From what I can see, this ultimately a failure in the regulation of US regional banks. My understanding of UK banking regulation is that this situation would not be allowed to occur with UK-regulated banks.

Certainly, I think it’s almost inconceivable that any of the big banks I’m writing about here could suffer this kind of problem.

–

2022 results season: As this year’s results season winds to a close, the UK’s big banks have emerged with mixed report cards.

The good news is that all five appear to be more profitable and in better financial health than at any point since the 2008 financial crisis.

Last year’s results from all five banks showed a substantial increase in interest income, improved lending margins, and strong capital positions. Increases in expected bad debt look relatively modest and manageable, so far. Shareholders are being rewarded with increased dividends and substantial share buybacks.

The less-good news is that banks’ management have taken care to paint a more cautious picture of the outlook for the year ahead. The general sense of their comments was that net interest margins (and possibly interest rates) may already have peaked.

A combination of macroeconomic factors and tougher competition…