So, not only is NEXT PLC offering a 50% discount to its

customers, but its share price fell by more than 50% to £38/share from

£80/share during 16 months. The REAL question is:

Does NEXT PLC shares represent a bargain like their clothing line or are we bracing for further reductions ahead?

A Quick

Glance of Next PLC

Looking at NEXT PLC’s fundamentals, it has operating margins at 20%* portrays a healthy retailer with decent margins that is higher than hot retailers like BOOHOO and ASOS of which its margins are between 4% and 7%, respectively.

These online retailers are growing faster than NEXT meaning future profits and margins will likely increase faster.

However, the PEG Ratio (keeps track of changing market value and earnings growth) put NEXT on 0.61, compared with BOOHOO’s 0.93 and ASOS’s 5.04 meaning the market places higher value to these online retailers’ profits than NEXT, despite having lower operating margins!

*NEXT’s operating margins have never been below 10% (going back to 1999)!

On the other side of the spectrum, luxury retailers like Burberry, LVMH and Hermes have more say on “Pricing”, therefore it can command higher operating margins. This is down to the power of their brand names projecting fashion status and social status (or, it could be the quality garments it produces). At the high-end of the fashion segment, NEXT beats Burberry’s operating margin of 17%, and are not far behind LVMH and Hermes.

These luxury retail stocks command higher P/S and P/E numbers than NEXT!

Does the straightforward and quick research proves NEXT PLC is a bargain for value investors?

Am no expert in the day-to-day running a clothing business, that’s for people like Philip Green and Mike Ashley. But, I do know how to analyse a retailer’s financials. And like any retailers, it needs to grow profits and generate cash.

Below, are the following factors you need to know about NEXT PLC:

A. NEXT PLC earnings power, which includes the subsequent cash flow analysis;

B. A breakdown of NEXT’s revenue breakdown, and why there is a surprise in its directory division.

C. A simplify, but useful analysis of NEXT PLC’s market and enterprise value in proportion to various financial metrics, including KPIs measures.

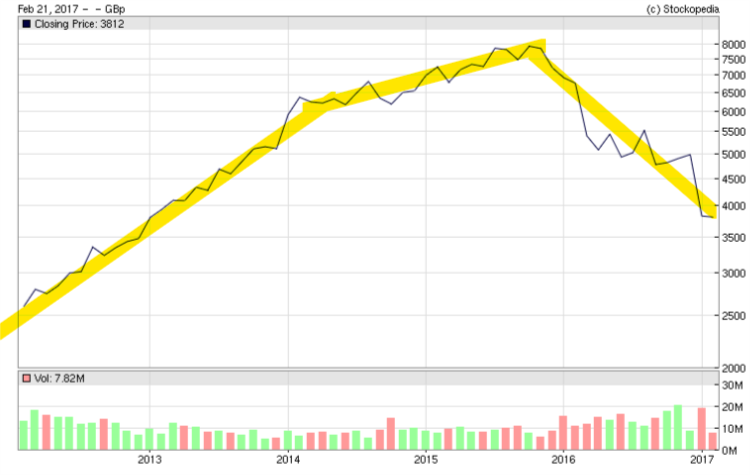

D. For those short to medium-term traders, a useful breakdown of NEXT’s technical analysis share price chart.

E. Finally, an evaluation and likely direction of…