Taking a stab at the uncertainty caused by Donald Trump’s victory in the US presidential election is no easy task. News of his win feels very similar to the news on June 24 that the UK had voted to leave the EU. On both occasions, the people had spoken, but it still felt surprising. So what should we make of this?

For the UK stock market, the EU referendum result caused some short sharp volatility. It also triggered a sharp devaluation of sterling. In the months that followed, though, equities rose sharply, particularly those earning chunks of their revenues in foreign currencies.

By contrast, the immediate impact of Trump’s win has been fairly muted in the UK. That’s despite concerns that there could be sharp sell-off in the States when markets open. Even if there is, the consensus view seems to be that equities will bounce back. So for investors looking for bargains amid political uncertainty, the US may prove to be the best hunting ground right now (but there is no certainty about that). In the case of a sudden sell-off, take a look at our article on surviving bear market uncertainty.

Mining and pharma are the early winners

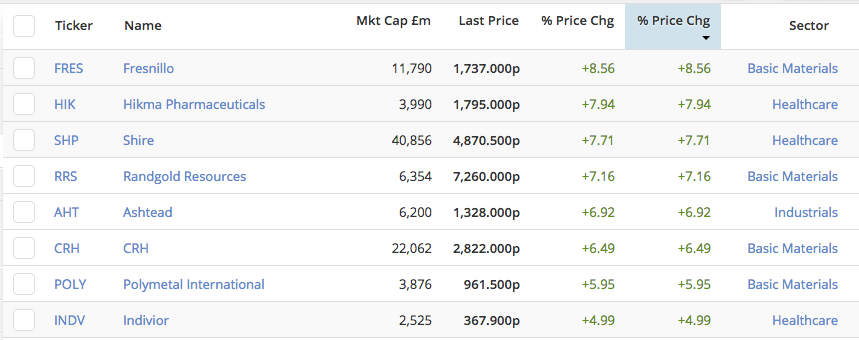

The early winners among UK large cap stocks are in the mining and pharmaceuticals sectors, with Fresnillo, Hikma, Shire and Randgold all up by more than 7%.

What the analysts are saying

In a note this morning, Hargreaves Lansdown said:

“With the operating landscape largely unchanged we believe the losses incurred today will in all probability be made up by many companies relatively quickly, as calm returns and more adventurous investors move in to pick up a bargain.

“Having said that, markets could remain volatile in the days ahead and there could be further falls. Markets can have a tendency to overreact to big political news, and, as we saw following Brexit, they can bounce back relatively quickly. However, there are no guarantees, so investors could get back less than they invest.”

Standard Life Investments:

“Trump’s election introduces significant uncertainty to the outlook for government policy, economic activity and the US Federal Reserve (Fed). Market volatility has spiked in reaction to the result and we expect this to continue over the coming weeks amid speculation about his likely policy agenda. However, we stress the importance…