Three decades of bumper house price and population growth have made for a comfortable foundation for the UK’s housebuilders and construction companies. Their share price trajectory reflects that.

And in 2020, after the lowest decade of house market growth for 30 years, when everyone thought the fun was coming to an end, government stimulus alongside Covid-fuelled demand for properties with gardens, sent the market soaring again. According to data from Nationwide, the price of the average UK home has risen 26% since the start of the pandemic.

The housebuilders, unsurprisingly, got another boost. These were some of the worst sold-off companies during the March 2020 Covid-19 market crash, but some of the biggest risers in the following months.

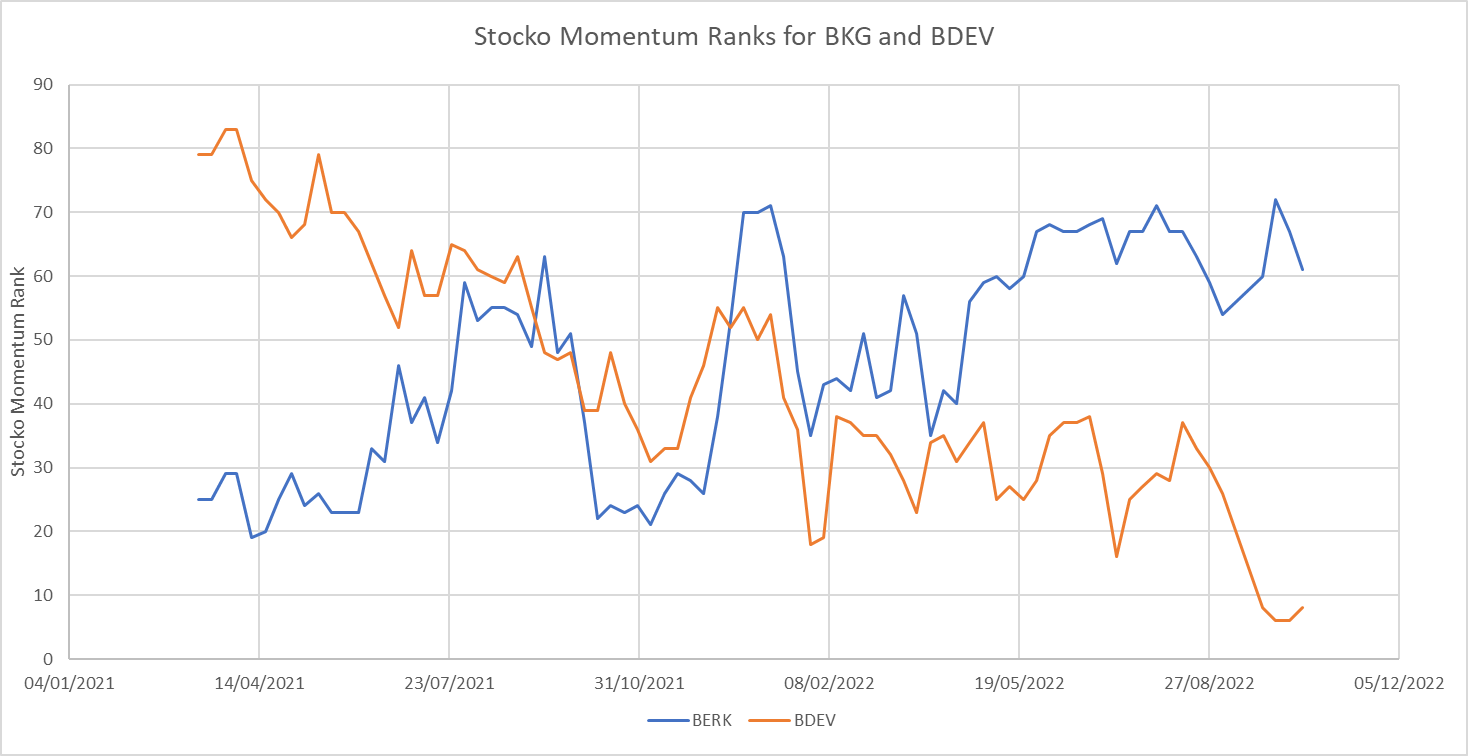

But in 2022, their share prices haven’t fared so well. As housing market concerns have ramped up alongside government economic initiatives, their prices have been falling fast.

Safe as houses?

In the last two years the housing market has drifted into bubble territory, inflated by short-term interventions and unusual behaviour. In the final quarter of 2022, house price rises are forecast to rise by 5% year on year.

But that froth is expected to blow out of the market in 2023. In early October Knight Frank revised its forecasts for the next few years, saying that if prices rise 6% in 2022, they will fall by 5% in both 2023 and 2024, breaking the streak in growth which has lasted for 13 years.

This shouldn’t come as a surprise. The housing market has behaved irrationally in the last few years and some of the froth needs to come out of it. It’s the long term outlook that is more concerning.

Housing affordability and the proportion of a buyers’ salaries which are consumed by their mortgage is a key measure of housing market health. In recent years the challenges new buyers face has been in their deposits, rather than the affordability of mortgages. But that is changing. According to Rightmove’s most recent housing market report, average monthly mortgage payments have risen from about £750 in early 2020 to £1100 today, equivalent to 27% of disposable income in 2020 and roughly 32% today. A general rule of thumb is that if monthly mortgage payments are less than a third of disposable income, there…