I spotted these shares mentioned in a popular broadsheet and looked into it further.

They are paying a 20% yield which looks too good to be true.

A summary of the investment is in their quarterly update (the link provided below from last month - June 17th 2021).

The investment is essentially a bet on a three things:

1) That Emirates airlines remain a going concern

2) They don't renegotiate the terms

3) The trust can sell the 4 Airbus A380's for a reasonable amount at the end of the tenure. All proceeds are returned to shareholders.

Regarding my thoughts on the above:

Point 1) - Emirates is essentially state backed by the Dubai authorities and is effectively their national carrier. They have already provided cash support and in my view are unlikely to let it fail.

Point 2) - No requests for any renegotiation has been received by the trust to date. It seems that the closer we get to the end of the year, with vaccination rates as they are, the less likely that will be.

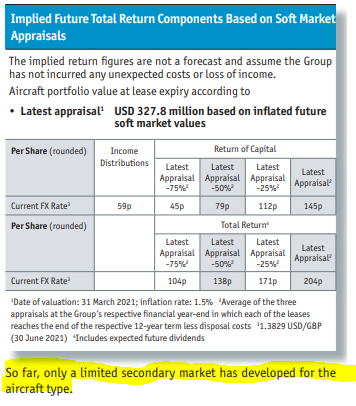

Point 3)- According the their last quarterly update in June (LSE link here), they have use three independent aircraft valuers to predict the sale price of the aircraft at the end of the Emirate tenure and applied various markdowns from the worst case of 75% to 25%. I assume this is where the biggest risk may lie but even in the worst case of a 75% markdown to the sale price, the total return of this investment (so including all quarterly dividends payments for the next 4 years) is 59p. The 50% markdown of the valuation estimates gives a total return of: 75p which is 63% return on today's prices.

I took a small position as I don't know much about A380 values apart from what I read in the Economist (i.e. don't expect more than 30% of their original price, but I believe this has been factored in).

Has anyone looked into this or have experience of any other similar vehicle, I'd be interested to know your thoughts.

All the best,

S.