Takeovers have been a frequent theme of our daily reports, and are an ongoing source of return for investors in the UK market.

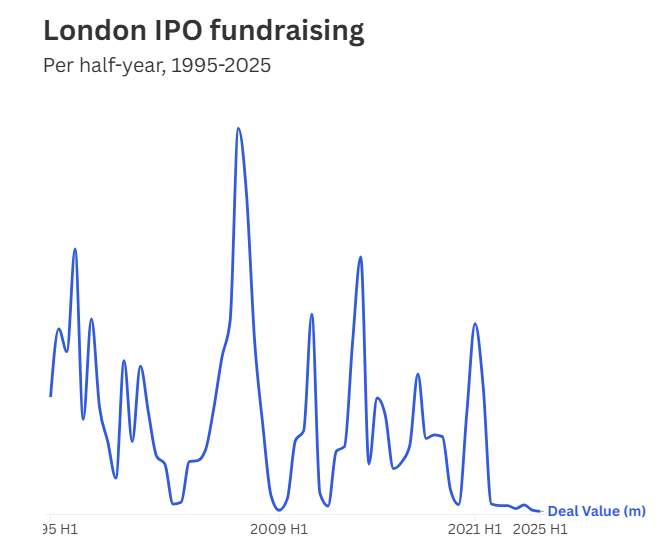

However, I can’t be the only one - and judging by our comments sections, I’m not - who is concerned about what this means for the long-term health of the LSE. Judge for yourself, but it seems to me that the companies being targeted for acquisition tend to be of higher-than-average quality, and in some cases they are being snapped up at rather underwhelming takeover premiums. And they certainly aren't being replaced by IPOs of a similar quality, as there have been hardly been any IPOs for years. In fact, IPO fundraising has hit a thirty-year low.

Source: dealogic via CNBC

This personally impacted my portfolio recently when International Personal Finance (LON:IPF) (I still hold) announced a recommended offer from a US investor. The premium against the prevailing share price was only c. 24.9%.

I acknowledge that this is very much a first world problem, but IPF is a stock that I intended to hold for the long-term, and I was excited about what the company might achieve in the years ahead. It was a company that I had researched, had gained familiarity with over a period of several years, and where I felt that I understood many of the pros and cons of an investment. If its share price had gained 25% in a year without any takeover offer, I would not have been terribly surprised.

Seeing this leave my portfolio is therefore not a prospect that I’m looking forward to, even if it will give my portfolio an immediate boost. I don’t come across opportunities like IPF every week, so I won't immediately know what to do with the proceeds.

An overview of takeovers we’ve noticed in recent months

To give some context for what I’m talking about, here are some companies where we’ve had the colour “PINK” (signalling takeover activity) in our daily report. I've tried to sort them roughly by the takeover premium.

Empresaria (LON:EMR): possible offer from a UK source at a 148% premium (will it go ahead?).

Spectris (LON:SXS): a private equity battle between Advent and KKR, with KKR ultimately offering £41.75 plus a dividend. This is a…