I last looked at Empresaria back in May and in my report concluded that the company turn-around was proceeding very agreeably. At the time my key concerns revolved around the lack of top-line growth, remaining debt load and lack of reward for key shareholders. So with the half-year results recently released now seems like a good time to review progress on these fronts and check if management are following their expressed strategy.

Results and statements

The problem with company results (apart from quarterly reporting companies) is that they provide a snapshot of affairs only twice a year. This is why trading statements are so important; they're a chance to gauge intermediate progress and how bullish management are about the business. Now Empresaria isn't a prolific reporter but they do put out trading updates twice a year and the AGM Statement from May is worth reading - principally because it's positive and projects reasonable confidence:

The Group has made a good start to the year, delivering like for like growth against this period in 2014. Each of our three regions, the UK, Continental Europe and Rest of the World are profitable and growing and the investments made in 2014 are performing well, in line with our expectations.

Four months later the half-year results are similarly positive but with the added twist of business running ahead of expectations:

Based on performance to date, we are confident that results for the full year will be ahead of current market expectations and look forward to delivering further growth. Despite increasing currency headwinds, market conditions are generally favourable and we see further opportunities to grow our business over the coming years.

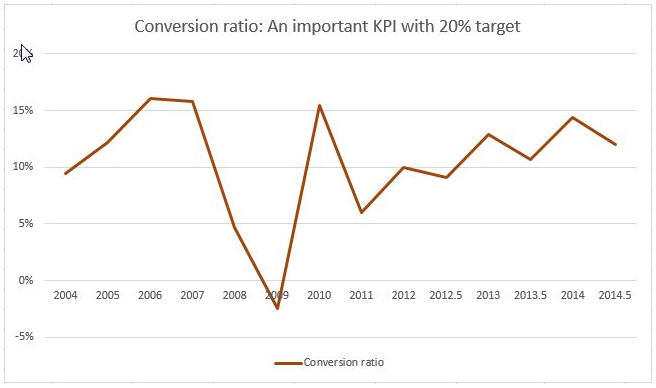

So it all sounds pretty progressive and that's why the share price jumped by around 16% on publication day, to 82.5p, and has maintained this level since. The headline numbers themselves are strong with profits up by a third (44% in constant currency), net debt stable at under £10m and a conversion ratio of 12%. The latter number (operating profit divided by net fee income) is a KPI and its trend in recent years is just one reason why I think that the company has further to go:

Management set an explicit target of 20% for this ratio and since 2011 it has steadily climbed, with clear seasonality, towards both this level and…