This is another article in a series of education posts from Alan Hull. Alan Hull is a renowned technical analyst within the Australian Market. He has educated thousands of investors on how to apply technical analysis within their overall strategy. In this special series, Alan has agreed to share his Technical Analysis tutorials with Stockopedia members. He has committed to provide one ever three/four weeks. To learn more about Alan you can read his profile here. Or visit his website alanhull.com.au

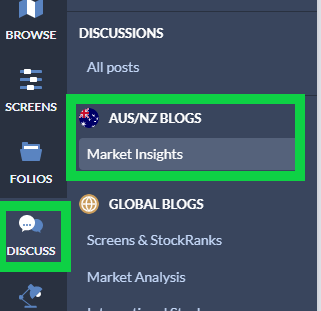

To re-acquaint yourself with Alan's prior postings, please go to “Discuss” in the left hand column and selecting “Aus/NZBlogs” (see below). Scroll down and you will find a contribution one to every three/four weeks.

Support and resistance

Previously we looked at both rising and falling trendlines but there’s another type of trendline which has a special significance…horizontal trendlines. And just like all other aspects of technical analysis, it’s very important to understand the behavioural basis behind horizontal trendlines if we are to use them effectively and with complete faith.

Imagine a share that trends up in price to 72 cents and then remains around 72 cents for an extended period of time. From this behavior it can be deduced that most of the recent buyers acquired their shares at or near a price of 72 cents.

If the price of the share rises from this level and then falls back to 72 cents, the large group of buyers at 72 cents will have enjoyed paper profits. Human greed will motivate them not to sell at or below 72 cents because of their recent profitable experience as they are now aware that the price can go higher. In doing so they provide support for the share at 72 cents by refraining from selling.

If the price of the share falls and then rises back to 72 cents, the 72 cent buyers typically become sellers at 72 cents. Fear motivates them to sell at the point where they can break even. In this case the 72 cent buyers, turned sellers, provide resistance to the share price at 72 cents.

Thus the price at which a share remains for an extended period of time takes on special significance. The price of 72 cents is said to be a level of support and resistance. On a bar chart you can…