Continued from here. [And most definitely, this is the last post in the series!]

This might actually be the perfect time to write about emerging markets – the developed market douche-bags (DMDs) are out in force again, warning us emerging markets are tanking… It’s a common refrain: a) developed markets are in recession, emerging markets must tank, b) developed markets are showing zero growth, emerging markets must tank, c) developed market growth’s bouncing back & rates are rising, emerging markets must tank, and d) well…emerging markets simply must tank!

2013 may turn out to be even sillier. So far, most of the year’s been spent denigrating – nay, reviling – emerging markets, simply because developed stock markets have done so well. Of course, the sub-text here is ‘why don’t you just forget/sell emerging markets (forever) & just stick to developed markets?!‘ Christ on a rope, that’s like handing out bloody gold medals to whoever took the most steroids… And now developed markets have caught a dose of the colly-wobbles in the past week or two – again, DMDs would have you believe it’s another good reason to sell emerging markets. Yes folks, we’ve finally reached the point of reductio ad absurdum:

i) Developed markets go up – sell emerging markets,

ii) Developed markets go down – sell emerging markets, and

iii) Don’t forget i) & ii).

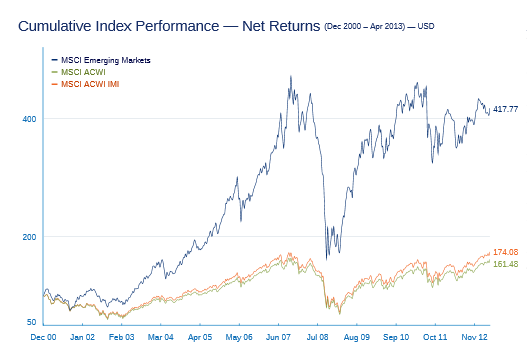

Of course, the real absurdity is far more obvious – why don’t we all enjoy this chart again:

But when has compelling evidence ever got in the way of belief, no matter how deluded..?! However, I will admit there’s a couple of other (real) issues facing emerging markets right now:

a) The market’s forward-looking (say on a 1-2 yr horizon), and it discounts accordingly. Which often causes it to appear irrationally sensitive to inflection points, or even changes in the rate of change (of GDP growth, corporate earnings, etc.). Right now, the market appears to be reacting to an anticipated narrowing of the growth gap between emerging & developed economies.

This phenomenon’s frustrating – a suddenly less bad economy’s stock market massively out-performs another market whose economy has marvelous fundamentals (why not substitute the words ‘company’ & ‘earnings’ here also!). And all your hard work, research & analysis is simply wasted… But that’s the expectations game for you, and sometimes you just want to throw…