Woodside Energy (ASX:WDS) have been appearing consistently in the Most Viewed in the Community list for months now, so I though I would have a look at them and see what I came up with. This type of company is why I gave up financial modelling. There is a lot of moving parts to a company like this haha.

Intro:

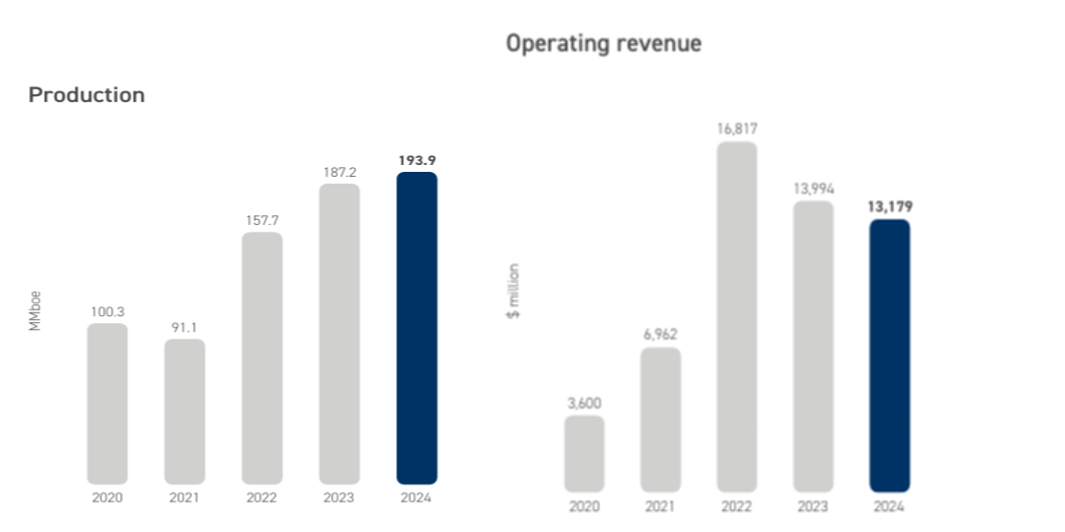

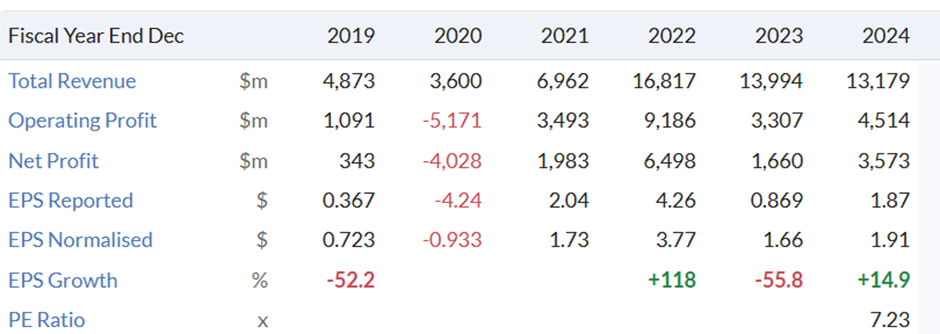

Woodside Energy (ASX:WDS) have been a pioneer of the oil and gas industry in Aus since their beginnings in 1954, when they started exploration and drilling for oil near the small Victorian town of Woodside. To commissioning Australians largest ever LNG resource The North West Shelf off the northern cost of WA and exporting Aus first LNG cargo. Since their humble beginnings, WDS has grown into a global oil and gas producer and explorer with a market cap of AU$40bn, at the time or writing, with revenue of US$13.1bn and record production of 194MMboe in FY24.

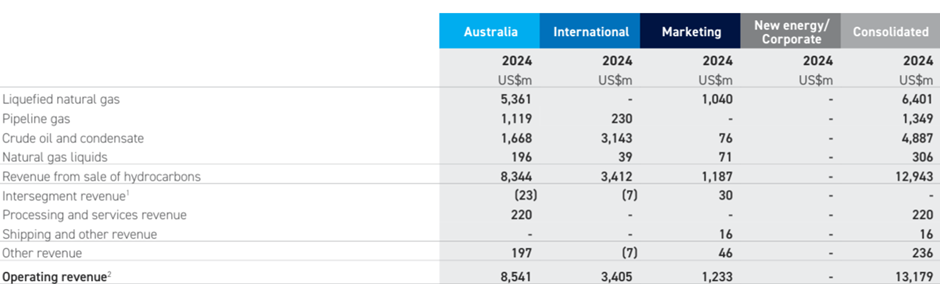

WSD generates its sales, earnings, and profits through four business segments, which are Australia, International, Marketing, and New Energy/Corporate. With the Australian business segment, the largest, producing the bulk of revenues and profits. In FY24 the Australian segment contributed US$8.5bn or 64% of FY24 operating revenue of US$13.1bn.

The corner stone of WDS’s business is the production of natural gas liquids for exports to customers for energy generation.

On 1st June 2022 WDS merged with BHP’s petroleum business to create the largest listed energy company on the ASX and a top 10 energy producer globally. This was done for the consideration of 914m new shares in WDS to BHP shareholders and doubled the amount of WDS shares on issue.

Since the merger WDS has managed to increase their production of oil and gas substantially. With sales, earnings and profits fluctuating with higher costs and a rising and falling oil price. WDS had an average cost of US$8.10boe, while receiving average revenue of US$63.60boe for FY24.

I would also encourage anyone reading this, to peruse WDS website to fully understand the impact they have had on Australia’s oil and gas industry and to understand the true scale and size of their operations, as I am…