Hi All,

In my last post, just as we entered Lockdown in the UK, my Fantasy Fund called "Technology Trend" had just passed the 3-year mark. I thought I would add a quick update to cover what has happened to it over the Covid period so far.

As a reminder, you can view the Fund if you switch to Stockopedia's "old" site layout and then follow the link below:

https://www.stockopedia.com/fantasy-funds/technologytrend-6621/

Previous posts on the Fund performance are here :

3 year post : https://www.stockopedia.com/co...

and

original post : https://www.stockopedia.com/co...

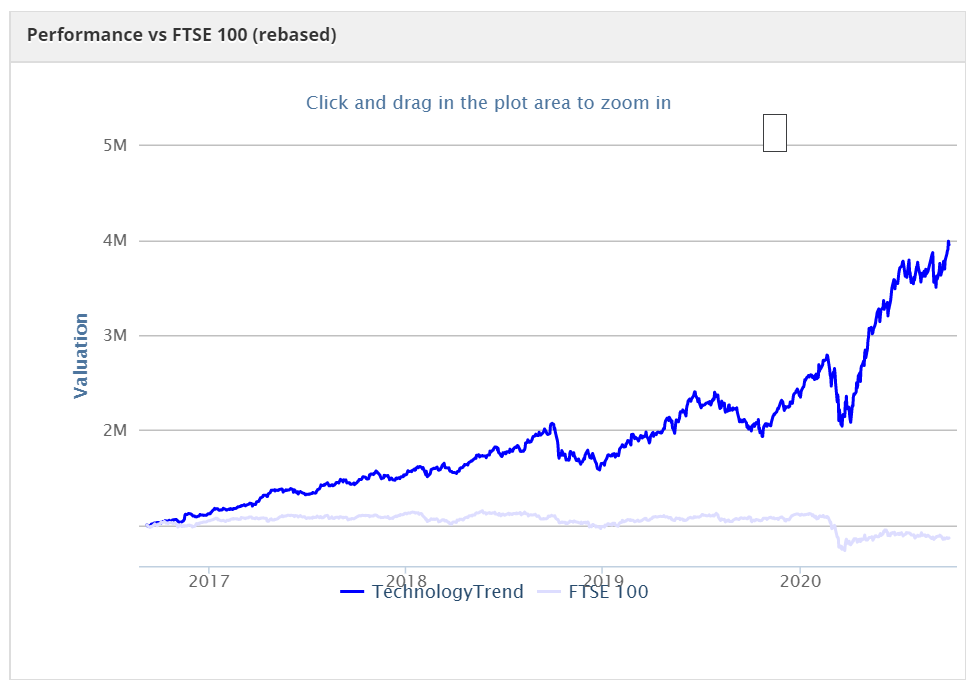

So this is what Covid has looked like for a basket of Technology only shares....

As you can see, while the humanitarian impact of Covid has been awful , the performance of the fund since the initial Covid dip has been nothing short of amazing. The fund has close to doubled in size since the initial Covid crash and now stands at over 4 Million and a more than 40% annualized return (My target was an ambitious 30%).

I have had to trim some position sizes in order to stay inside the "no share more than 25% of the fund" rule but have reinvested that into some new ideas which I hope will climb over time.

Not everything has worked out, I have ditched a few that haven't moved in the right direction. It's worth noting that the big loss (Netease) isn't really a loss at all but the result of a share split that Stockopedia isn't able to deal with in the Fantasy Fund.

I hope that some of you find some inspiration for share ideas by looking at the constituents of the Fund. Do we think the Tech bubble is about to burst or is this just the future playing out.

Happy stockpicking all,

Cheers

Carey