Continuing our summer theme of looking at some of the Guru Screens, I was intrigued by the Charles Kirkpatrick Bargain Shares screen. This is based on a rather interesting finding that Kirkpatrick wrote up in his book Beat the Market, which is something I'd not come across before. He found that when combined with a measure of price strength, stocks tended to outperform if their relative price-to-sales ratio fell between the 17th and 42nd percentiles in terms of cheapness.

This is how this would be implemented in the Stockopedia Screening Tool:

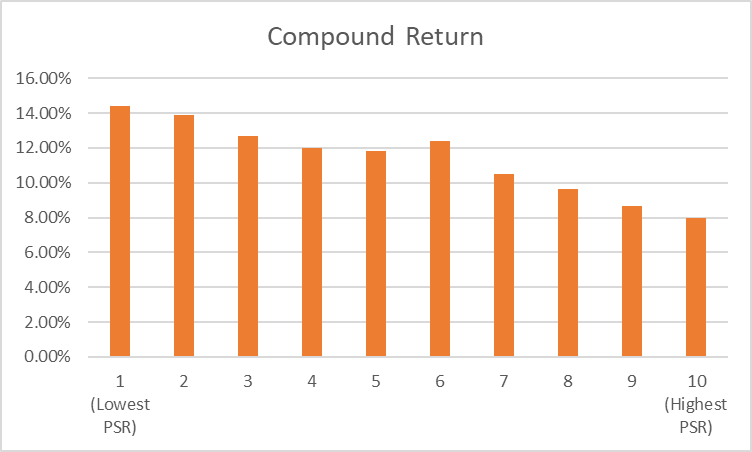

Kirkpatrick doesn't explain why but simply says it was the best-performing range in his backtests. This is an unusual result because a lot of the academic studies on Price-to-Sales show data similar to this, taken from James O'Shaughnessy's What Works on Wall Street, which Kirkpatrick references:

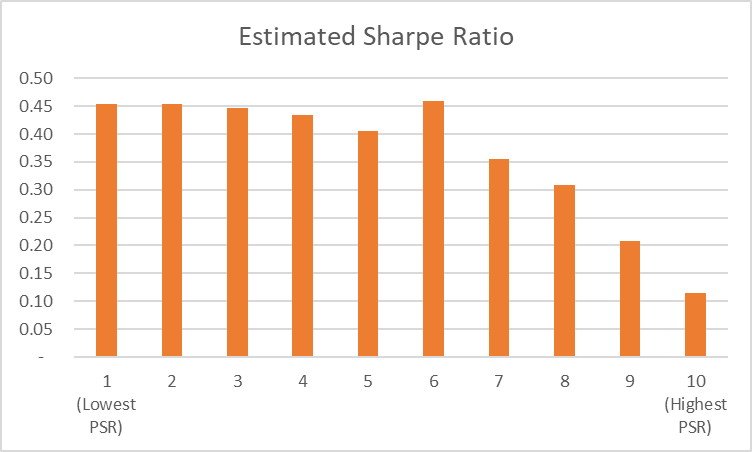

However, if I estimate the Sharpe Ratio for the same data using a 5% risk-free rate, I get a slightly different picture. (The Sharpe Ratio is a measure of the excess return per unit of volatility and recognises that investors typically prefer a less volatile path of returns.)

The highest 40% of stocks, as measured by price-to-sales, seem to perform poorly, but the outperformance of the lowest decile comes at the cost of higher volatility. While Kirkpatrick's precision in recommending the 17-42nd percentile is probably due to data mining, it is easy to see why the middle price-to-sales deciles could be a fertile hunting ground when combined with other factors. For this, Kirkpatrick used a simple moving average test to find the bargain stocks that were moving in the right direction:

![]()

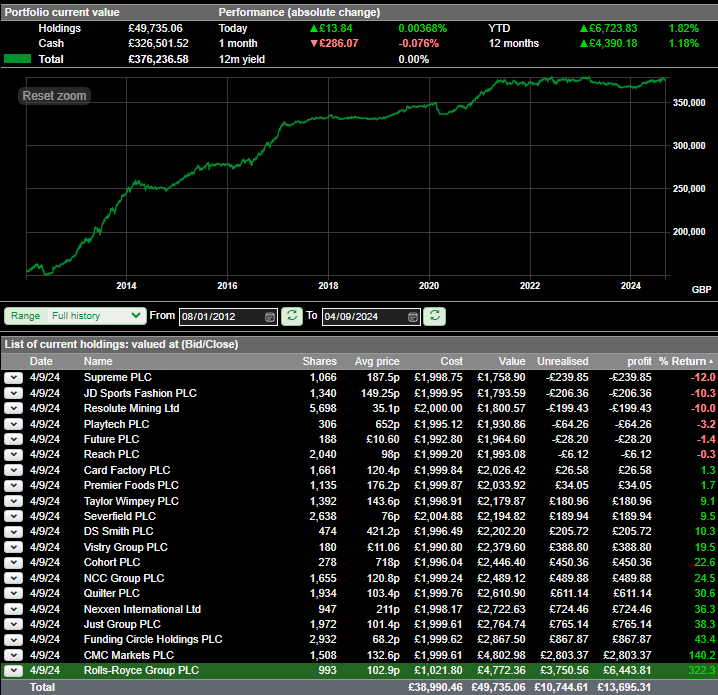

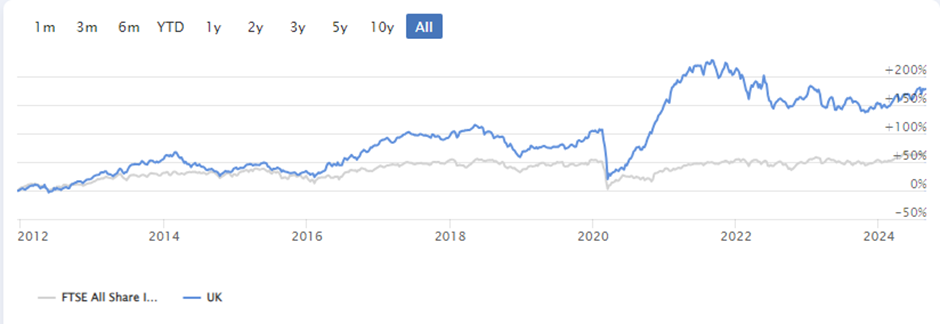

The original screen looks at companies with a market cap greater than £200m. The long-term performance of this screen is a little mixed. It seems to go through stages of being a very strong performer but gives back those gains during periods of market turmoil.

The interesting thing is that it has been one of the better-performing bargain Guru Screens in 2024, so we may well be entering one of the periods where this type of stock significantly outperforms the market.

As is my…