UK markets are particularly difficult to navigate at the moment. A combination of poor investor sentiment, government missteps and a problematic geopolitical landscape make investment decisions challenging. Several currently competing narratives add to the uncertainty, pulling investors in different directions:

Uncertainty

Value vs Outlook

On many measures, UK stocks and smaller companies in particular, are incredibly cheap. However, consumer confidence is weak in response to higher taxes and the challenges of funding all the government spending commitments such as pensions, schools and defence. This makes the outlook for many UK stocks highly uncertain. Investors may buy shares in a company on a forward P/E of 6, but if those earnings estimates are halved, a forward P/E of 12 may no longer look attractive. Unexpected profits warnings are catching out many investors at the moment.

US Protectionism

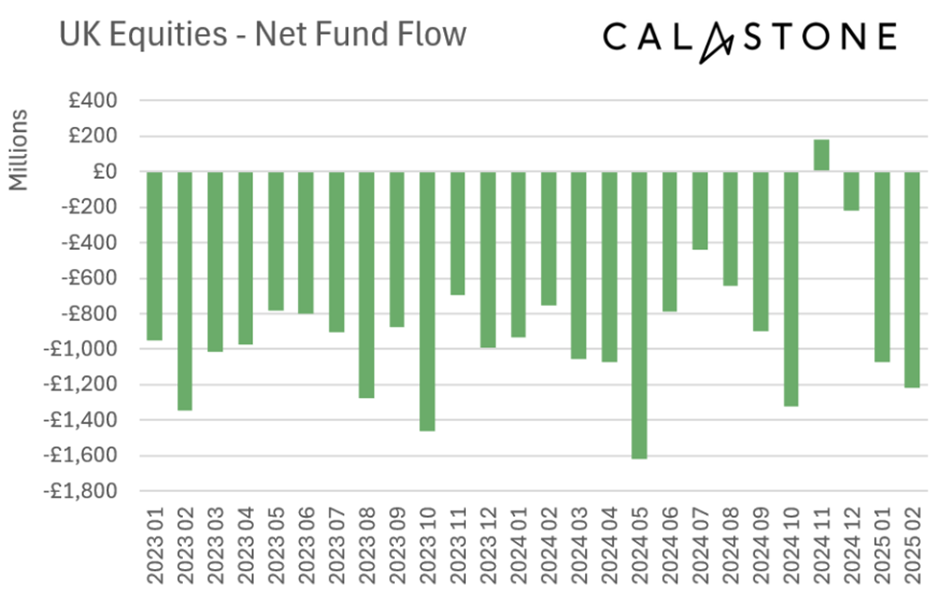

There is a certain irony to a UK market that didn't soar with the US in recent years but sells off in sympathy as the US markets tumble. It may be some salve to note that the UK indices are outperforming the US ones in 2025. However, as they say, you can't eat relative returns. The reality is that the increasingly protectionist policies coming from the US may well be bad for the UK. The UK may have avoided the worst of the headlines so far, but some industries will be impacted, and the randomness of decision-making means we may be next. With these challenges, fund flows into UK equities remain negative, as this chart from Calastone shows:

Momentum works, until it doesn't

Given the messaging from the US and the response from Europe, many defence stocks have seen their share prices outperform recently. However, it is far too soon to see the effect of any changes in outlook in financial results. Several defence companies have warned this week, such as Qinetiq (LON:QQ.) and MTI Wireless Edge (LON:MWE) . It seems that investors were wrong to hope that trading conditions for defence stocks would improve, at least in the short term.

Similarly, small mises against forecasts for high-flying investor favourites such as Beeks Financial Cloud (LON:BKS) and Warpaint London (LON:W7L) have seen these stocks lose over 30% of their value in the last three months. Momentum is a powerful effect, and it can be even more savage on the downside…