A couple of weeks ago, I wrote about how the risk of tax changes in the upcoming budget may be driving the selling of UK small caps. We are already seeing the effects of selling to avoid changes in capital gains tax or the tax-free lump sum from SIPPs (both rumoured but not confirmed). This may get worse as any change to Inheritance Tax Relief on holding AIM shares would likely see advisors reposition clients into alternative assets. On top of this, there will be secondary effects, with fund managers seeing outflows from UK equity funds and the risk of underperforming closed-end funds going into wind-down. In my last article, I looked at the stocks most at risk from a possible sell-off in a particular fund, Miton UK Microcap Trust (LON:MINI) , showing how investors can assess the risk to individual stocks for similar situations.

While my last couple of articles have shown which stocks may sell off in the future, we may also be seeing bargains now, particularly if some of the worst rumours of tax changes for investors prove to be overblown. More adventurous investors may want to deploy capital now and take the long-term view on any price action, knowing that buying cheap growing businesses will eventually be reflected in share prices. After all, none of these rumoured tax changes will affect the fundamental value of listed businesses. It may be worth taking advantage of any recent sell-off now, and the Stockopedia tools enable investors to find these types of stocks.

The Screen

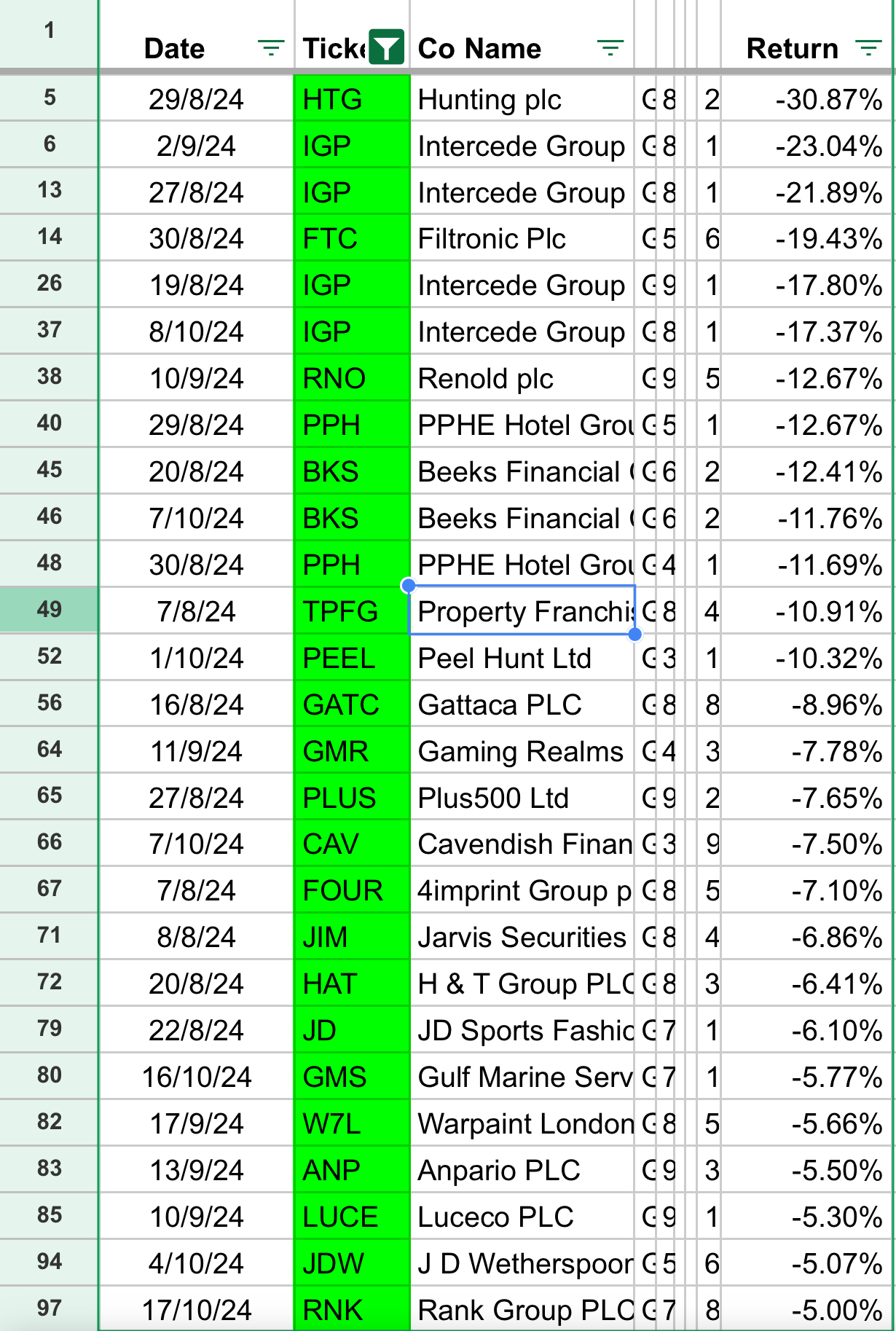

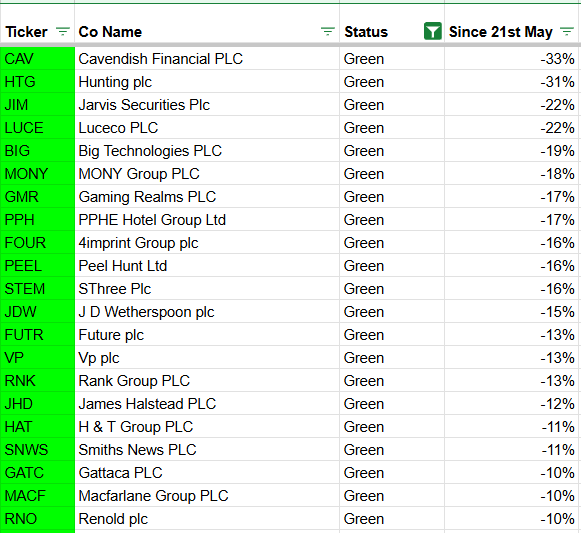

The Stockopedia Screener enables investors to search for the worst-performing stocks which may have been impacted most by tax selling over the last few months:

Here, my choice of 15% is arbitrary, but one of the mistakes Value investors make is missing how far a share price can fall when sentiment is against a stock. Buying when something has fallen just a few per cent is unlikely to represent a bargain purchase.

However, buying stocks that have suffered from a recent sell-off isn't necessarily a great strategy. Many of these will have sold off because something fundamentally has changed with the business. In a period of weak consumer and business sentiment, some companies will have fallen due to profit warnings rather than just tax-selling. For example, Oxford Metrics (LON:OMG) has fallen a whopping…