One of my big calls for 2026 is that takeovers will continue to be a big feature of the UK markets. Given the valuation disparity as you go down the size of listed companies, my theory is that smaller fish will increasingly be seen as dinner for larger predators from the UK and beyond. In a world where UK retail funds continue to see outflows, I also expect takeovers to be one of the primary sources of “accelerated price discovery” for investors this year. I laid out my full argument in the first article in this series.

Charlie Mungers, not Ben Grahams

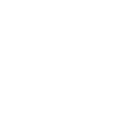

Last week, Alex added a more rigorous analysis of the data on what type of companies had received takeovers over the last few years. To be honest, the results surprised me. Acquirers were far more likely to be “Mungers” than “Grahams”. On the whole, they haven’t been buying companies significantly cheaper than market averages on most valuation metrics:

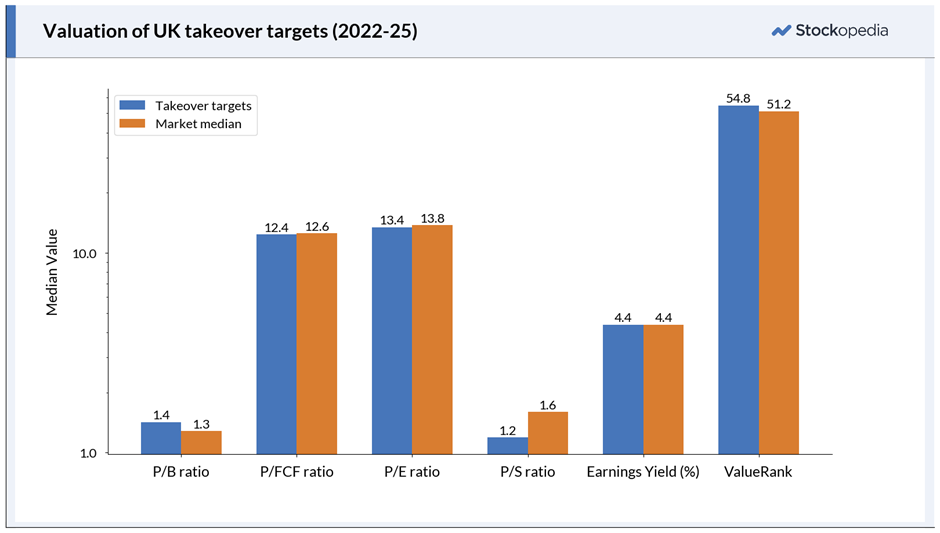

I would argue that valuations do matter, and it is the availability of stocks on a Price to Free Cash Flow of 12 that makes the UK a rich hunting ground for acquirers. However, once you go below market medians, this doesn’t make companies more attractive to the average acquirer. While companies aren’t necessarily buying bargain assets or earnings, they appear to be more discerning when it comes to sales. The lower-than-average Price-to-Sales ratio suggests that acquirers may be keen to acquire sales where they can generate higher margins through cost-cutting or synergies. Looking into the details, I find that Trade Buyers are less keen to pay a high P/S than Private Equity, giving credence to this theory:

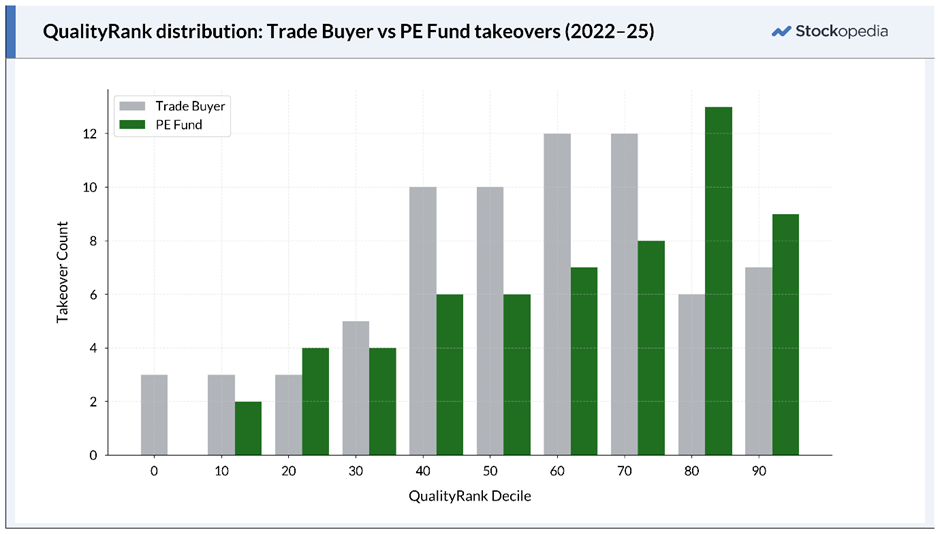

The most significant difference between takeover targets and the general market was the higher Quality Rank. Although again, this varied between the types of buyers:

Private Equity almost always preferred higher-quality stocks. However, anything above around 40 seemed to be ok for the majority of Trade Buyers. Part of this difference appears to be due to the preference for Private Equity buyers for a higher Piotrowski Score (which is weighted strongly in the Quality Rank). The median value in the Private Equity takeovers was…