A few reasons for liking Finsbury Food (LON:FIF) within the Small-Cap space now:

1. Strong Trading Statement from Monday, in spite of supposed pressures from supermarket clients:

The Board is pleased to report that since the positive AGM trading update in November 2014, strong trading performance throughout the Christmas period has continued. Total Company sales revenues grew to £107.6m, an increase of 24% on prior year. This represents organic growth of just over £4.9m, an increase of 5.6% versus prior year.

The Fletchers acquisition completed at the end of October contributed £16m of additional sales revenue. Consequently the UK Bakery division grew by 27.7% inclusive of Fletchers, with an especially strong seasonal performance from Cake. The Overseas division, the Company's 50% owned joint export business, also finished the first half strongly, resulting in flat sales versus the prior year and reversing the 3.1% decline reported for the first 4 months.

2. A Boring Business supposedly, which means that a lot of investors overlook it in favour of more "sexy" companies and sectors, like Mining and Technology.

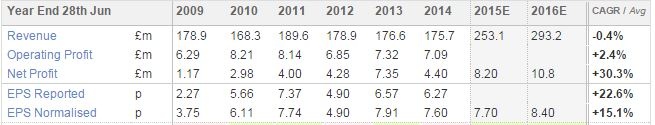

3. Growth is Steady, Fuelled in Part Smart Disposals and Acquisitions. Sales growth is impressive, reflected in a steady improvement in EPS.

Edmund