I looked at Finsbury Food (LON:FIF) a few months ago and found them interesting so, with their share price not too drastically changed, I come back to see if there's good enough value to include them in my portfolio. A brief recap on what they do - they make cakes and breads, and some more niche and specialty stuff too - most notably the (rapidly growing) gluten free range and licensed, branded products.

I looked at Finsbury Food (LON:FIF) a few months ago and found them interesting so, with their share price not too drastically changed, I come back to see if there's good enough value to include them in my portfolio. A brief recap on what they do - they make cakes and breads, and some more niche and specialty stuff too - most notably the (rapidly growing) gluten free range and licensed, branded products.

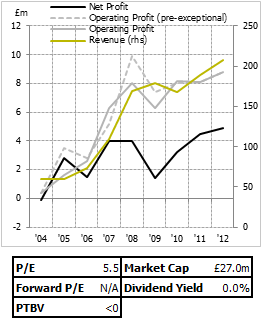

The first thing I'll say is that the P/E ratio is slightly flattering because the group carries more debt than most companies I look at. In essence - there's lots of people to pay off before equity holders get their money back. It's not critical by any means, but the significant leverage (they also have a decent amount of operating leases; not far off £10m when capitalised) does raise the risk of the group. It is coming down, and it's probably right that the company is choosing to do that and pay no dividends at the moment.

What's changed?

It makes most sense to start with the news, since that's potentially the biggest driver of a change of opinion since I last looked at them. Since then we've just had the one important bit - a pre-close trading statement for the first half of the year. The results aren't hugely interesting one way or another:

- Total Group sales revenues increased to £103.3m, versus £102m in the prior year period, in line with management expectations for the period.

- The UK Cake business grew 2%, £1.1m, broadly in line with the market whilst as forecast Lightbody Europe, the Group's 50% owned joint venture business, declined by £1.6m or 17% due to adverse exchange rate movements.

- The Group's Bread and Free From division continued to deliver strong growth, an increase of £1.8m or 7% versus the prior year, to give total sales of £27.4m for the period. This is an encouraging continuation of the divisions long term performance trend.

That everything is going in the right direction is positive. Post their (expensive) equity raising, and with the cash generated from continuing decent results like this, the group is reducing its own risk fairly quickly. This can only be seen as a good thing. A drop in revenue from Europe…

.png)