Hi Fellow Investors,

As we move towards potentially a second lock down as a result of Covid-19, some of us will be questioning how best to protect our portfolios from the inevitable knock-on effect this will have on businesses that we are invested in.

Many businesses unfortunately have been forced to close or are on the verge of closing due to cash flow issues. Thankfully there are companies out there with a vision as to how these businesses can be helped stay afloat.

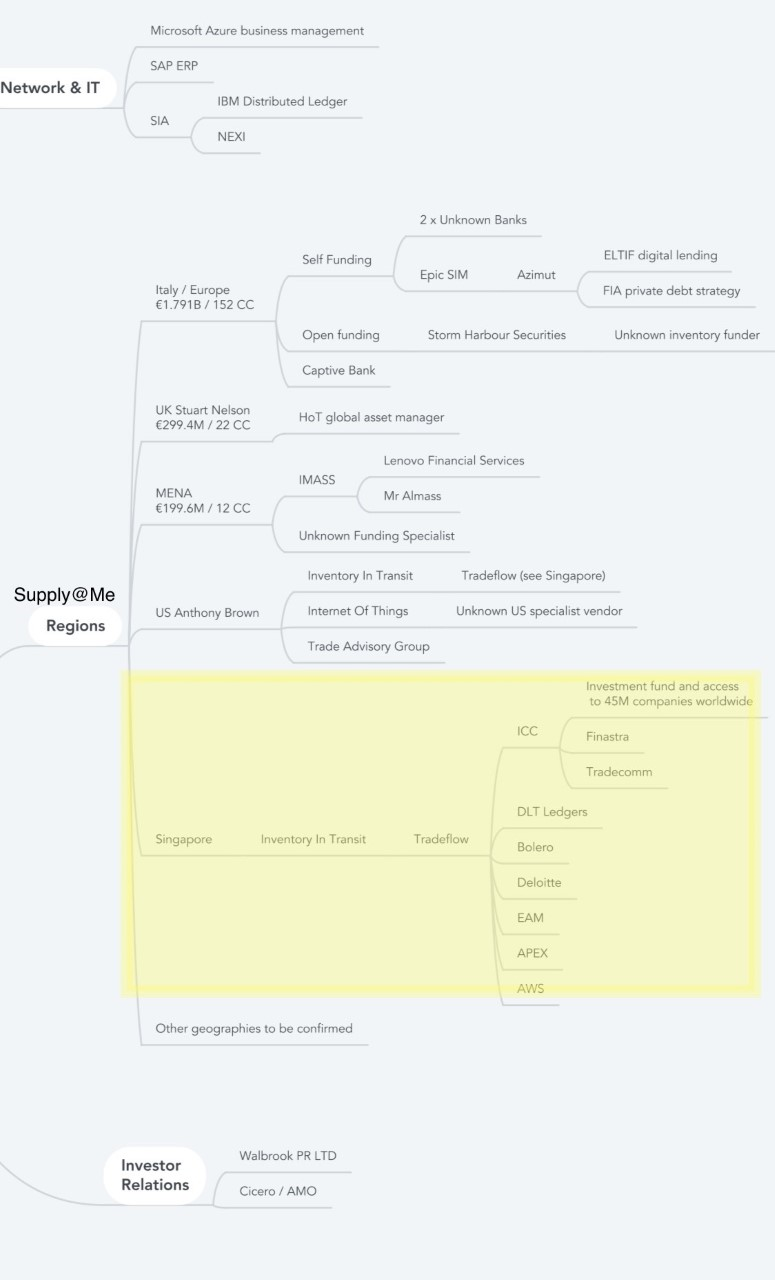

This is where Fintech and Supply@ME can help out . Fintech allows companies to secure cash flow on the back of their inventory.

For example, a toy manufacturer is potentially sitting on hundreds of thousands of pounds in unsold stock. At the moment it may not be selling, but that doesn’t mean it doesn’t have value. This business is a prime candidate to unlock equity backed up in their stock – and that equity wouldn’t rely on its credit rating being squeaky clean – it would simply rely on the value of its toys, which is steady. The working capital this firm could unlock from unsold would cover all its costs and could even allow it to pick up the pace when the pandemic does finally subside. Furthermore, this business would no longer be hoping that Christmas goes well, and a second wave of the virus would not have the same catastrophic impact on the company.

Until very recently, there was not a way for businesses to tap into these assets. Yes, you could securitise the value of a loan against unsold stock for a short-term fix, but debt is expensive in the long term, and can stilt business down the line.

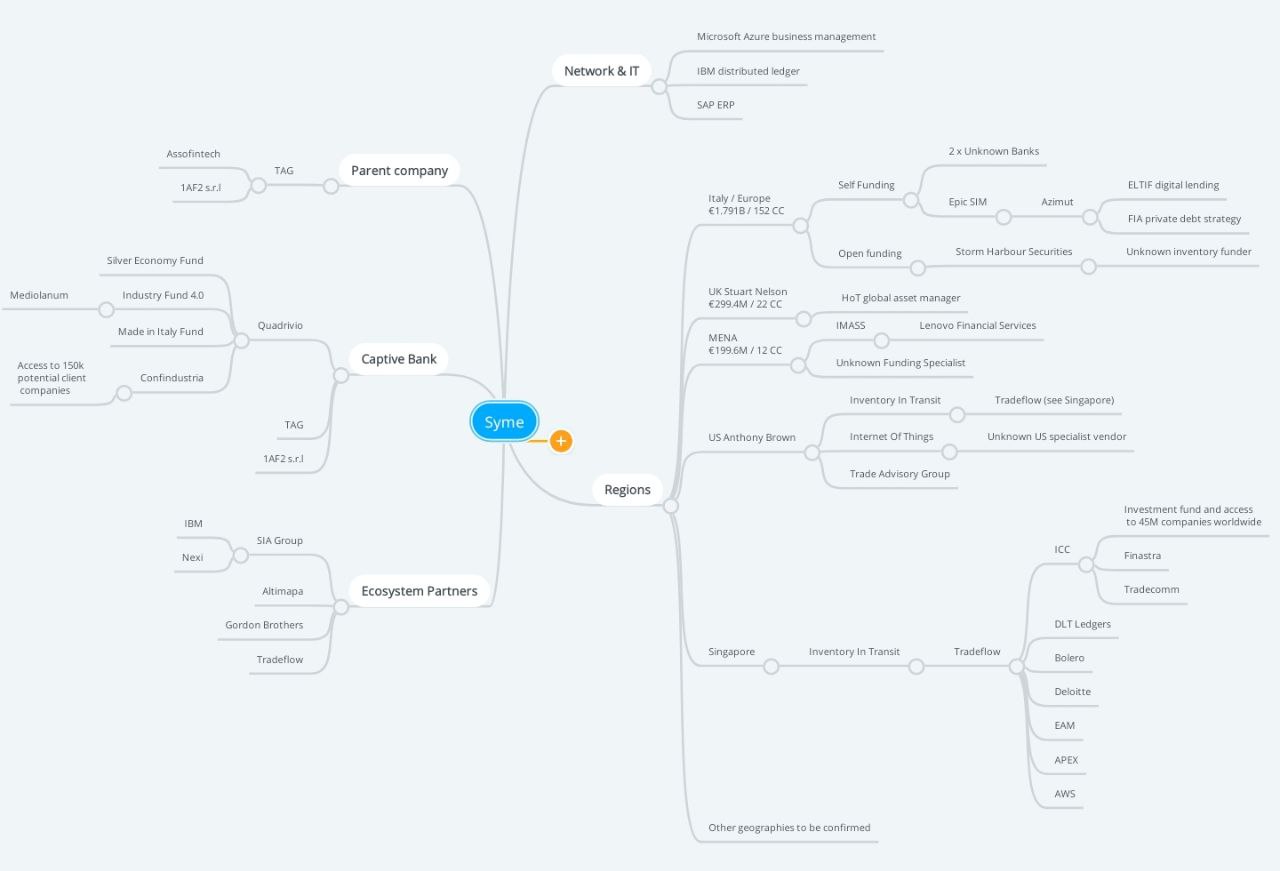

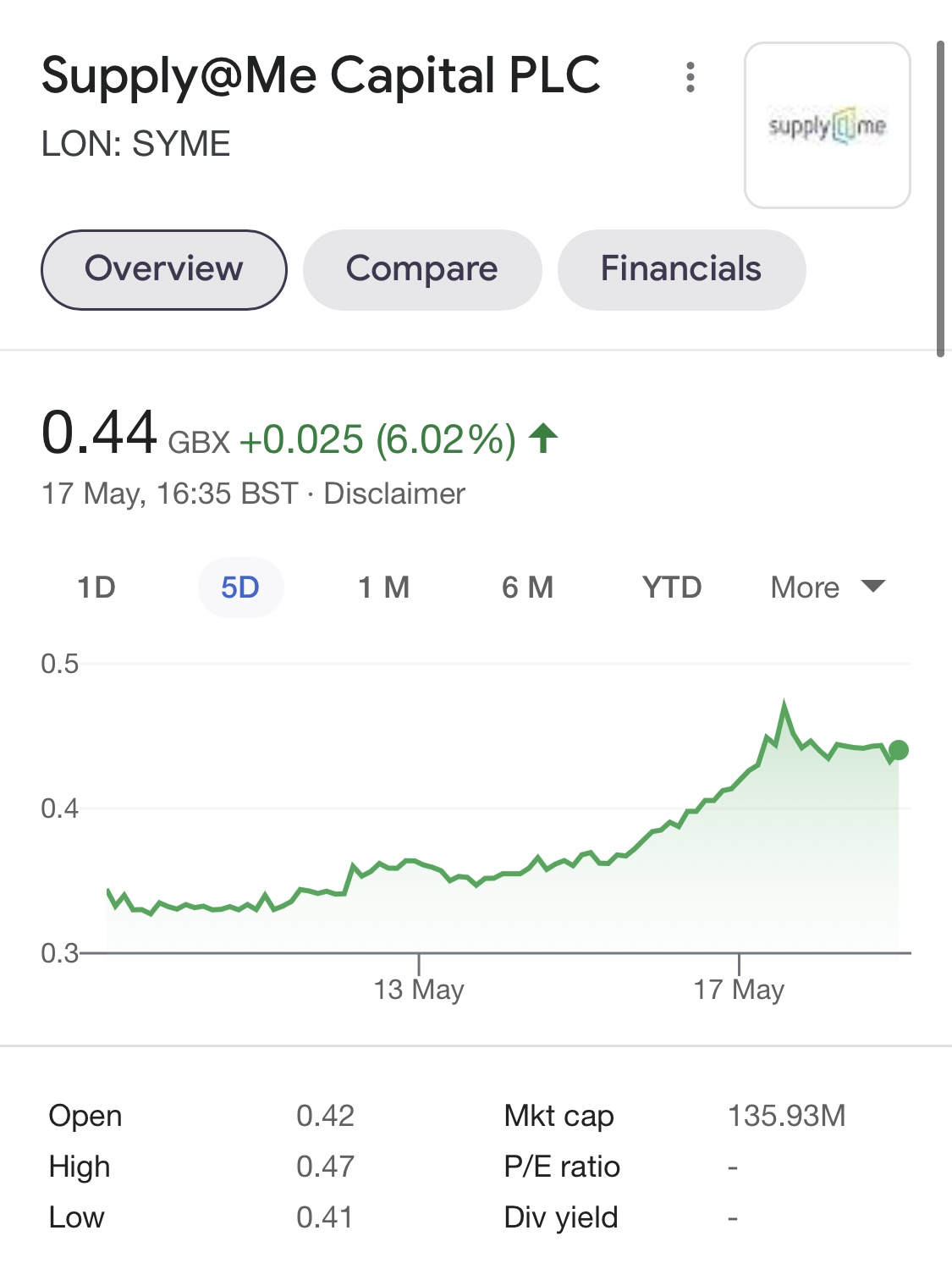

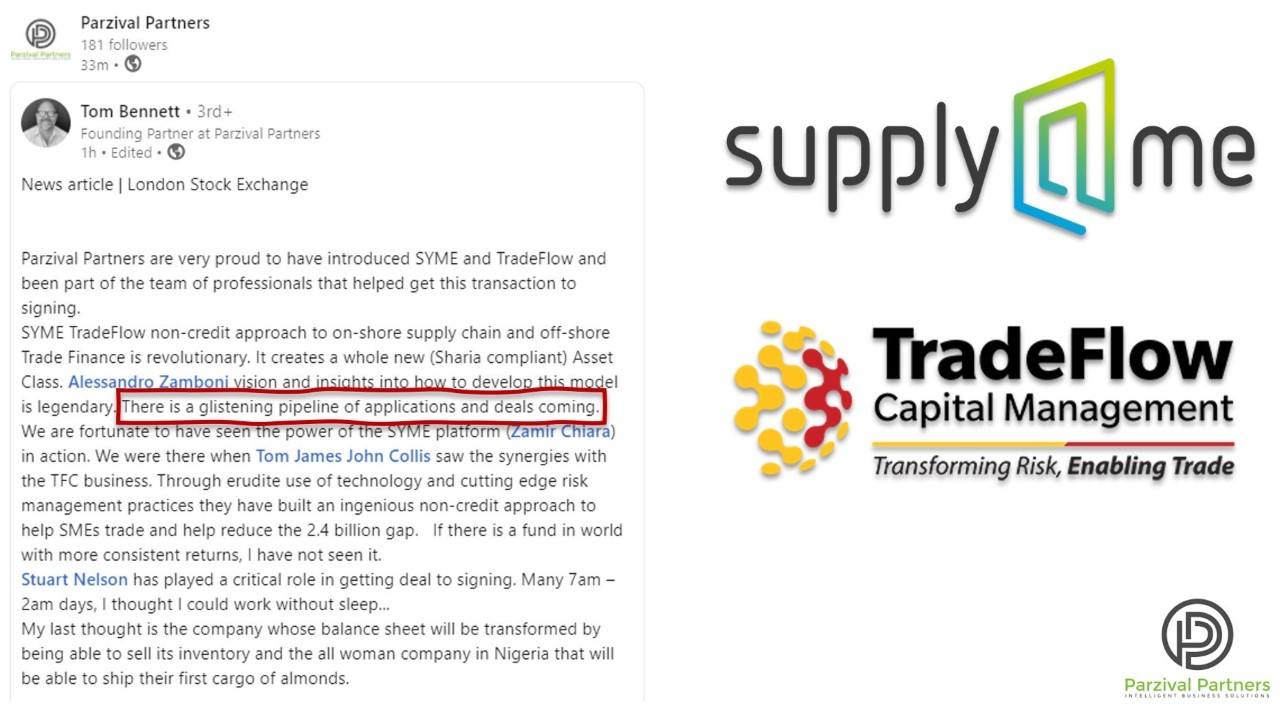

Supply@ME, offers a solution to businesses – and since their IPO on the London Stock Exchange in March, right at the start of the virus, have already partnered with banks, hedge funds, asset managers and other types of investors to unlock hundreds of millions of pounds for hundreds of businesses across Europe. But this doesn’t go far enough.

If businesses are to survive beyond the pandemic and not just survive its immediate impact, governments everywhere will have to find new, more creative solutions to funding businesses, and these need to be implemented quickly.

SYME's model of working capital through equity from monetising inventory could help thousands of businesses trade through and…