First Property (LON:FPO) was tipped by the excellent Simon Thompson in the IC recently. I'm a big fan of Simon's, and the article was compelling enough for me to complete a little more digging.

First Property (LON:FPO) is a 2 part business:

- An asset management business, (First Property Asset Management) with £620m under management as of 31st August

- The group manages 12 funds, comprising a mixture of third party and group capital

- A property group, with property exposure through:

- Invested capital in the funds it manages

- 8 directly owned and managed properties in Poland and Romania

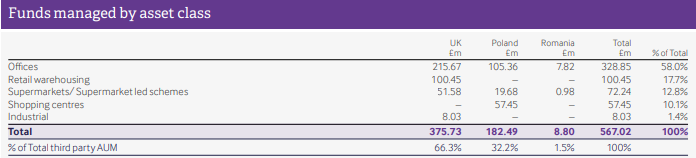

The geographical exposure, according to the 2020 annual report is as follows:

- UK:

- £375.7m through managed funds

- Nil through direct property holdings

- Poland:

- £182.5m through managed funds

- £49.8m in directly owned property

- Romania:

- £8.8m through managed funds

- £6.6m in directly owned property

First Property Asset Management (FPAM)

Looking into the annual report, we can see that for 2020 First Property Asset Management generated £3.89m revenue.

Currently the division looks to be performing strongly, with the following update on 21st September:

Average rent collection rates for the five months from the end of March 2020, after adjusting for concessions made to tenants which requested to pay rent monthly and for deferrals agreed, are as follows:

UK | Poland | Romania | |

8 directly owned Group Properties | n/a | 96% | 93% |

Properties held in funds managed by FPAM | 94% | 96% | 95% |

Considering the economic uncertainty, this seems like a resilient result. The sector breakdown does look exposed to an economic downturn with the below breakdown of usage for the properties managed in the FPAM business:

I am concerned about a heavy exposure to offices, particularly in the UK, which is expected to have one of the worst Covid-related contractions of major economies.

The below note is also interesting. Taken from the annual report, this appears to allow for some claw-back of profits from this division by clients if the offices division underperforms:

In the case of Fprop Offices LP, the Group is entitled to a share of total profits in lieu of fund management fees and to receive annual payments on account equivalent to 10% of total cumulative income profits and realised capital gains. Under its accounting policy the Group does not recognise unrealised property revaluations above the properties original cost. These payments are adjusted annually, if necessary, for any overpayments made in previous years up to a…