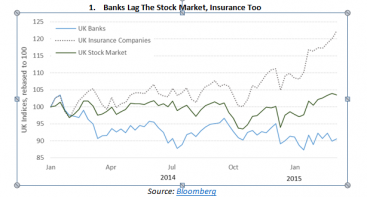

Should you really bother holding UK banks? At nearly 13% of the FTSE 100, banks are a large slice of the UK's premier stock market index. But their stock market performance has been far from stellar, under-performing the FTSE 100 by some 13% since the beginning of 2014 (Figure 1).

Note how another financial sector, the insurance sector, has in contrast performed very well, gaining 22% over this period while banks lost 9%.

Let's face it, there are a number of reasons why banks have done poorly of late and why they could continue to do poorly for quite some time to come...

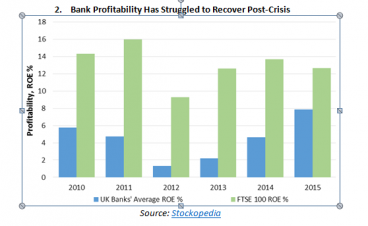

Profitability has collapsed since the financial crisis

Banks were heavily affected by the 2008-09 financial crisis, hitting profitability hard as they took heavy losses on all manner of exposures both at home and abroad, including bad loans on commercial and residential property. To the extent that bank profitability, as measured by return on equity (ROE), has still not recovered to pre-crisis levels, and has consistently lagged the average profitability of the FTSE 100 index (Figure 2).

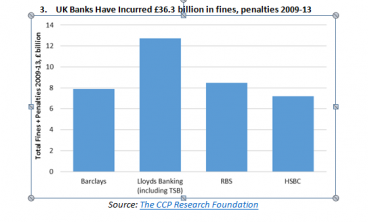

Regulation and fines have weighed heavily on the sector

One key reason for this lower level of profitability has clearly been much heavier regulation (from the Financial Conduct Authority and the Prudential Regulation Authority), and the myriad fines and compensation that the UK banks have had to pay for a variety of offences, including interest rate and foreign exchange rate rigging, mis-sold Payment Protection Insurance policies, breaching sanctions against Iran and Sudan, and other failures of compliance.

According to The Guardian, global banks have paid out a total of £166bn (€233bn, $250bn) in penalties and compensation for a long list of misdeeds and offences from 2009 to 2013. UK banks account for a colossal £36.3bn of this amount, led by Lloyds Banking (LON:LLOY) (Figure 3). Bear in mind this huge number does not even include the latest fines to be paid by £BARC and others over foreign exchange rate rigging penalties.

Dividends shrank considerably too

All of this has had a direct effect on shareholders, not only through subdued share prices, but also through lower dividends. All four UK retail banks have very low dividend yields, with only the global/Asian-focused