The following is a dicussion we had on Large Caps Live this week which opened my eyes to a lot of what is going on in the background with banks, hedge funds and central banks. It explains the equity market dislocation over the past few weeks and thought it would be good to share here as an article.

For those who don't know we run Large Caps Live every Monday at 11am discussing large caps and macro, plus Small Caps Live every Wednesday and Friday at 11am covering smaller company news. They are text-based live discussions led by a couple of 'hosts' on a platform called discord. Everyone is welcome to join in and contribute:

DangerCapital: Hi Everyone

WayneJ: Welcome to LARGE CAPS LIVE

DangerCapital: Thanks for joining the delayed LCL this week

DangerCapital: Thought we'd start off by looking in detail at why we now have QE infinity.

WayneJ: Great, I think that last week was momentous week but that equity holders have not really appreciated it.

I know most people on this channel are equity investors but there is a market even bigger than the equity market and that is the bond market.

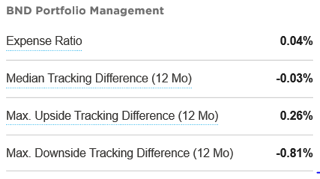

The biggest bond ETFs are LQD, HYG, AGG, TLT and BND. These ETFs usually trade very close to the value of their underlying assets (i.e. near 0% premium or discount to NAV).

For instance, if I pull up AGG we can see what the ‘tracking error’ has been:

Source: https://www.etf.com/BND#effici...

EXCEPT over the last two weeks that relationship broke down and these ETFs started trading at a discount.

For instance, this was an FT article from the 17th March 2020:

So this ETF - one of the world’s biggest - went from a typical tracking error of 0.03% to 6.2%

(Similarly, some people will notice that the spread between bonds and futures widened which was part of the same dislocation.)

Now before we discuss what happened let’s touch on why these ETFs normally trade in line with the underlying assets. Since these bond ETFs are so large (e.g. the article above reports that BND is a $55bn ETF) it is used as a proxy for the bond market. And there are lots of players who arbitrage it against the underlying bonds (or equivalent sets…