Don't know if anyone else has been mulling the Funding Circle prospectus. The key figure is an EV of 13x current year revenue, and another 300 million of cash to fund more IT and marketing.

As a business, I rate Funding Circle the pick of the bunch of the peer to peer lending businesses in this country. But a market cap of around 1.5 billion just feels too rich to me. Anyone else have any thoughts?

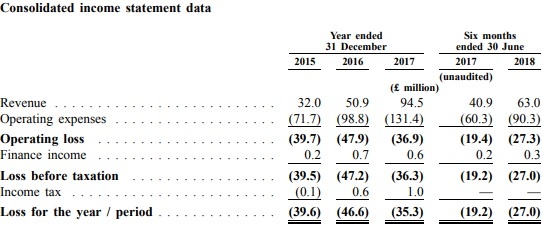

Funding Circle is seeking to raise £300m (net of £17m expenses) - part of the funds are to used in marketing the brand to raise it's profile. It's history is one of consistent losses:

Funding Circle’s IPO follows sales of shares in similar companies on US stock exchanges, which have left initial investors out of pocket. Lending Club, a US peer to peer lender, debuted in New York in 2014. Its market capitalisation shot up to $8.5bn on the first day the shares were traded. Today the market capitalisation sits at $1.6bn.

https://www.stockopedia.com/sh...

I don't think this type of business model would generate much interest in the Dragons Den - where are the entry barriers?