Investors are more likely to outperform the market by investing in profitable, financially stable companies that have rising share prices and are still cheap - at least according to finance academics. For instance, Professor Robert Novy-Marx explains that ‘tilts towards value, momentum and profitability have outperformed the market’. In terms of Stockopedia’s StockRank framework for classifying shares, companies with this profile are called ‘Super Stocks’. They often have strong Value, Quality and Momentum Ranks (see here).

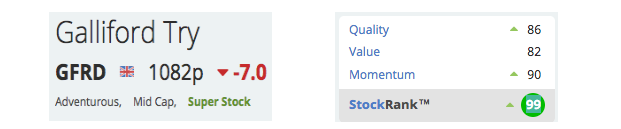

On 12 September, the house builder Galliford Try (LON:GFRD) published its annual financial statements and the company’s StockRank Style changed from ‘neutral’ to Super Stock. In this piece we take a closer look at Galliford Try’s respective Quality, Value and Momentum Ranks in order to discover why it has become a ‘Super Stock’ and explore what this means for the firm’s future prospects…

What does Galliford Try do?

Galliford Try is one of the UK’s largest housebuilding and construction companies. The company has three divisions: Linden Homes develops private homes for sale; the ‘Partnerships & Regeneration’ division works with local authorities to supply mixed-tenure housing; while the ‘Construction’ division tenders for construction contracts in the public and regulated sectors. The firm has a market cap of £1.2bn and is currently a constituent of the FTSE 250 Index.

Breaking down Galliford Try’s StockRank

We can see from the top of Galliford’s StockReport that the company has a strong StockRank (99 out of 100) and the firm is classified as a ‘Super Stock’. At the start of September, the StockRank was just 69 and the company was ‘Style Neutral’ (see here). The StockRank changed around 12 September, when the company published its financial statement for the year ending June 2018. When this happened, the respective Quality and Momentum Ranks improved, while the ValueRank remained stable. Indeed, in the image below we can see that the Quality and Momentum Ranks have little green triangles next to them, indicating that the rank has improved by 5 points or more over the last 30 days (see here). The ValueRank does not have a triangle. Let’s explore why the ValueRank remained static...

Galliford’s ValueRank

Galliford Try’s current ValueRank is 82. Before the company produced its annual results, the rank was 86. Based on this measure, it has been, and continues to be, relatively cheap -…