It’s results week, which means it’s time for unsuspecting investors around the country to spit out their coffee as they’re overwhelmed by the semi-annual barrage of RNS releases and trading updates.

Today’s new news is Games Workshop’s well-received annual report, but I’ve taken another look at SDI as well, which released Final Results on the 21st.

Games Workshop has broken the 9,000p barrier - an amazing achievement - so let’s dive right in.

Games Workshop (LON:GAW)

- QM Rank: 98

- One-year relative strength: 121%

- Share price: 9,065p

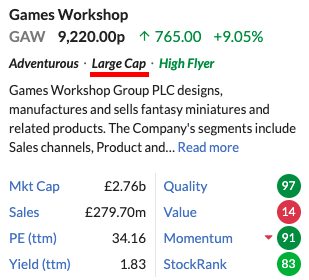

- Market cap: £2.76bn

(I hold)

Games Workshop (LON:GAW) is officially a large cap - that’s some feat for this exciting growth stock. Shares are up 9% on today’s Annual Report, meaning GAW sails past the 9,000p mark.

This group designs, manufactures, and sells fantasy miniatures and related products in both its own stores and third party trade outlets. Alongside this, it has an online store and a growing licensing division that sees games makers and other media providers leverage GAW’s IP.

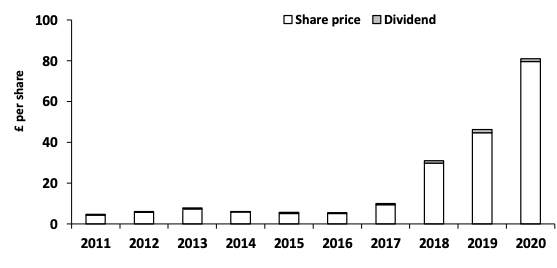

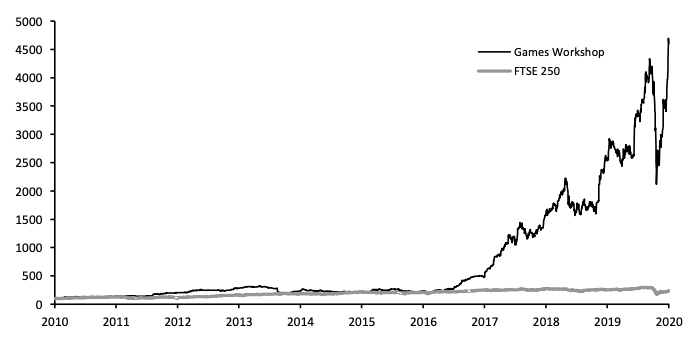

It’s been a fantastic ride for shareholders since 2016 and a real case study in ‘running your winners’ so far:

Despite the challenging backdrop, this was another record performance from the Games Workshop team: a fourth year of record constant currency sales, profit and cash generation.

These annual reports are always a pleasure to read. When you find management commentary that is unique, colourful, and distinctive it shows that the team is not just phoning its performance in to shareholders. Another company that jumps to mind in terms of distinctive commentary is Goodwin. Any others out there people know about?

GAW's performance since 2016 has been stratospheric and the management team continues to execute against a substantial global market opportunity.

COVID disruption

The group says that after a great 2019, performance in H1 and into H2 was strong until COVID forced GAW to close down its business on 24 March 2020.

In April, the group reopened. That GAW ended the financial year with revenue of £270m and profit before tax of £89m is a ‘tremendous’ achievement according to chairman Nick Donaldson.

Around six weeks of sales and profit were lost as a result of COVID. I’m going…

.jpg)