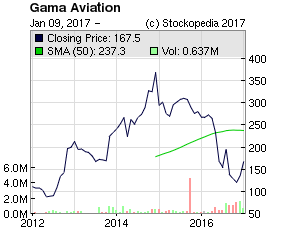

Gama Aviation (LON:GMAA)

Share Price 155p (up 14% today)

Market Cap £70.2 million

The Company

Gama Aviation is involved in the business of chartering, managing. and maintenance of planes as well as providing plane engineering training courses.

Latest News

Business news was pretty light on the first day back for trading in London for 2017. Only one piece of business news caught my eye. That news came from Gamma Aviation plc at the start of trade on the proposed teaming up of Gamma Aviation with BBA Aviation in the management of their combined fleet of 200 planes. The share price jumped 14%, in early trade reflecting some initial excitement with today's announcement.

“Gama Aviation Plc teams with BBA Aviation Plc to create the US's largest Aircraft Management Business” |

Valuations

Shares in the airline sector always appear cheap. Shares in this sector always seem to be on relatively low p/e multiples, despite good results. Historically, shareholders just don’t seem to do that well in this sector. It is due to the cyclical nature of the business with regular boom and bust periods. Investors getting on-board at the wrong time.

Synergy Benefits

Seems a worthwhile win-win deal for both companies with little overlapping in geographical areas. Gama Aviation may have done a slightly better than BBA Aviation in the terms of the agreement.

| Provides national geographical coverage with BBA's predominantly West Cost based fleet complementing Gama Aviation's currently East Coast centric business, creating a national network to enable further growth in this highly fragmented market. |

Increased Profitability

Nothing too major or ambitious on immediate profitability with additional revenue matching additional initial costs. The re-branding costs presumably are the additional costs. This appears to be a relatively low profit margin area, so competition must be keen from other players.

| Expected to deliver significant cost synergies of not less than $2M over two years. Expected to be earnings neutral in 2017 and 2018 and earnings enhancing thereafter, before the benefits of cross selling maintenance services into the enlarged fleet. |

Earnings

The share price rise today added £10 million to market capitalisation. Shareholders will have a 2 year time delay before any payback and some profit growth from the teaming up. Current forecasts are circa 25p earnings per share to the y/e 31/12/16. More will be known on January 9th with a trading update.

The…