Gear4music might be about to turn a corner.

Anybody out there with a young child learning the drums will be painfully aware of this online musical instrument retailer.

The group was founded in 1995 by current CEO, Andrew Wass, who retains a chunky c34% shareholding in the £40m company. Back then, Wass was a sound recording engineer who spotted an opportunity to supply small recording studios and educational establishments with digital recording solutions.

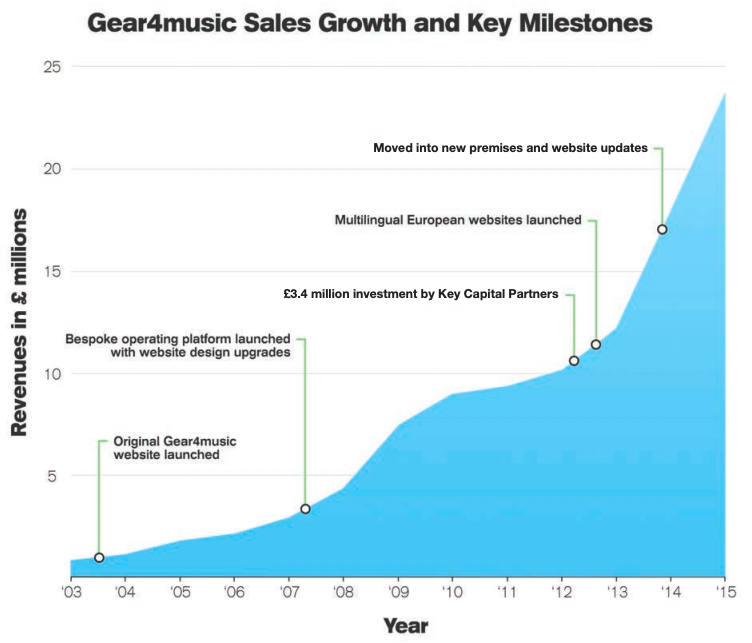

In 2003 Wass began to look into retailing own-brand beginner level musical instruments. He wanted to make them more accessible by selling at lower prices than in traditional music shops. Wass placed a bulk order for guitars, listed them for sale, and notched up an encouraging £0.65m of revenue in year one. He was onto something.

From this point on, sales grew strongly every year.

In March 2012, private equity group Key Capital Partners invested £3.4m to enable further development of G4M’s ecommerce platform and expansion into Europe. Some 18 country-specific websites were created for customers in Ireland, France, Spain, Portugal, Germany, Netherlands, Belgium, Denmark, Norway, Sweden, Finland, Italy, Switzerland, Austria, Poland, Czech Republic, Slovenia and Slovakia.

Source: Admission Document

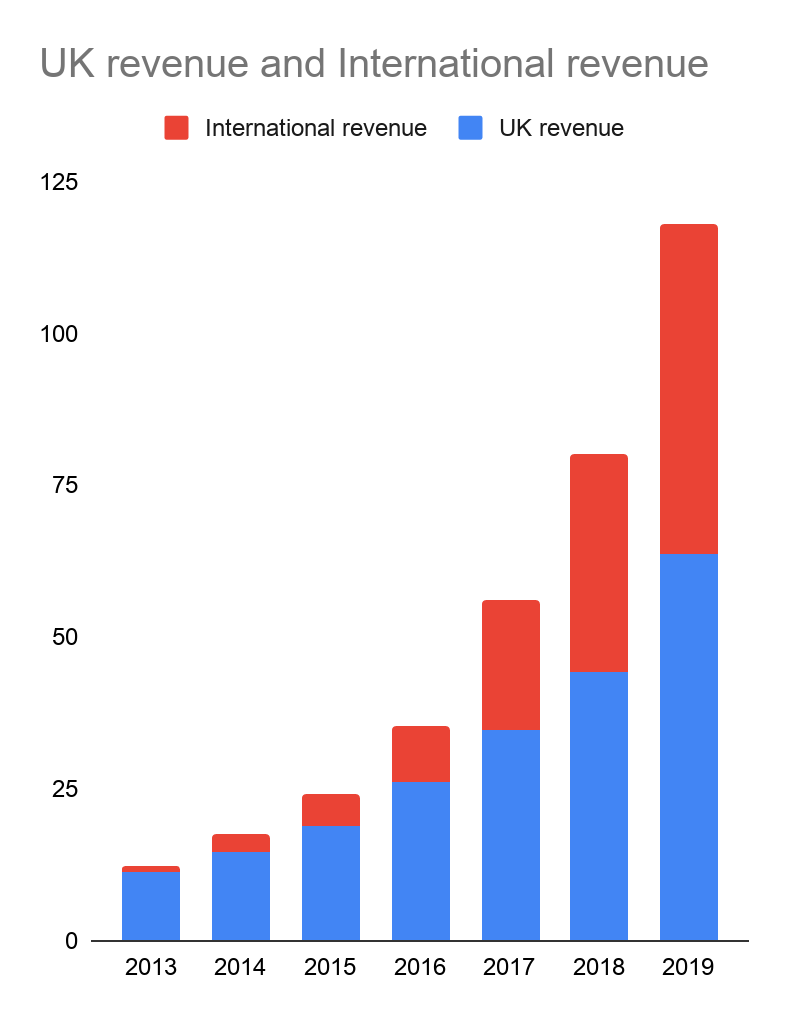

This rapid top line growth continued post-IPO. Here’s the table - strong growth by any standard.

2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

Revenue (£m) | 12 | 18 | 24 | 35 | 56 | 80 | 118 |

YoY growth | 44% | 37% | 46% | 58% | 43% | 48% |

Market overview

It looks like there is plenty more blue sky to aim for.

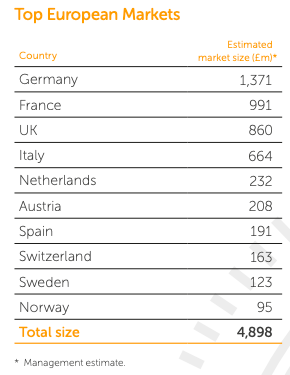

In December 2017 Music Trades estimated the global music products markets in 2015 to be $15.9bn. The top ten European retail markets for musical instruments and music equipment (including the UK) are estimated by G4M management to be worth £4.9bn. There is the added tailwind of a profound shift towards online retail.

Source: 2019 Annual Report

There is still growth to be had in the UK in consolidating a fragmented market.

Meanwhile in Europe and the rest of the world, there is plenty of opportunity. The group has invested money into building its showcase and distribution networks across the continent and efficiencies should arise as trading scales up.

At this rate, I’d say G4M’s International division is one or two years away from surpassing the UK in terms of revenues.

FY19: faltering margins lead to share price crash

For all the talk of double digit revenue gains and global opportunities,…

.jpg)