Gear4music Holdings (LON:G4M) and Focusrite (LON:TUNE) both provide music products and software online. Both also score well in terms of quality and momentum (G4M with a QM Rank of 87, TUNE with 98), and both also have their own founders still as top shareholders (see G4M here and TUNE here)

That is where a lot of the similarities end, however. Dig a little deeper and we have two quite different businesses in terms of established quality and profitability.

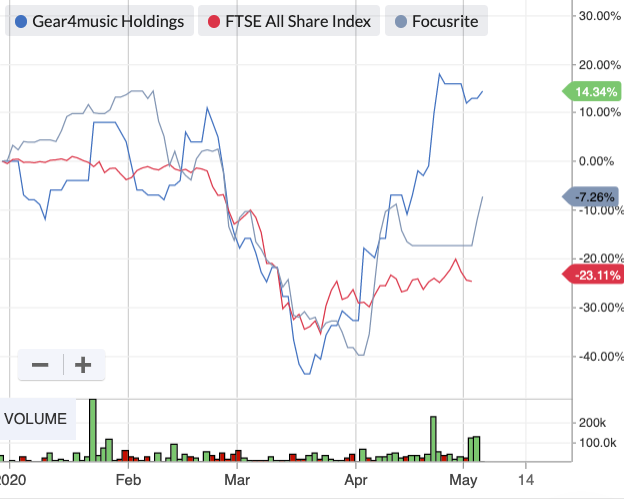

I last wrote about G4M on the 6th of April and noted that its prospects might be improving. Since then, shares are up by about 42.5% to 288p. In fact, its shares have nearly doubled since March 18th. The company has struggled to make profits in the past but some are clearly anticipating this will change. It is “cheap”, with a price to sales ratio of less than 0.5x.

Focusrite, on the other hand, has been very profitable for many years now. It has been a great success for shareholders. It has a superlative track record of high returns on capital and free cash flow. It is “expensive”, with a price to sales ratio of nearly 4x.

Both companies, I think, are quite well placed to navigate these conditions. Staying at home for so long may or may not permanently change habits, but I think it will almost certainly nudge established long term trends further along. One of the big trends of the past decade has been the shift to online retailing.

So will these two companies continue to be winners long after lockdown?

Edit: on an unrelated note, I see BOTB has once again surprised the market. It’s an interesting company. Paul is covering today’s news here and I covered it a couple of weeks ago here if you want to take a closer look.

Gear4Music

Market cap: £59.7m

QM Rank: 87

1y relative strength: +90.6%

What does it do?

Gear4music sells own-brand and third-party musical instruments products in the UK, Europe and the Rest of the World.

The group has struggled to prove the profitability of its business model though. This led management to introduce a raft of operational changes recently. The change in tack appears to be winning some people over.

A subsequent share price rally makes G4M a…

.jpg)