In last week's article, I looked at the benefits they get and the risks they face when companies choose to finance themselves using debt. I introduced tools that will help investors decide that a company has taken on too much debt and is setting itself up for a fall. This week, I describe some more advanced tools that may give early warning signs of financial distress.

Days Sales Ratios

Last week, I suggested that it should have been obvious that the company Beeks Financial Cloud (LON:BKS) required additional equity capital after it released its results to the 31st of December 2021. It is worth noting that this, in itself, is not a problem. Companies are usually listed because they previously required additional equity capital or will need it in the future. Beeks had no problem raising equity capital in April 2022 and did so at a minimal discount. The challenge is that raising equity may be very difficult in the current small cap investing environment, especially if it becomes evident that a company desperately needs it. Many funds are selling to meet redemptions rather than looking to invest further capital.

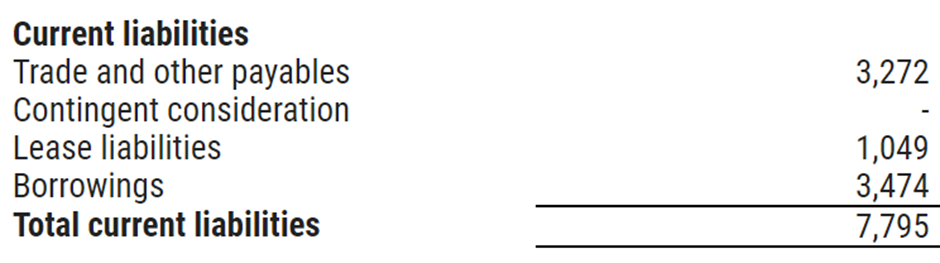

One thing that stood out to me in the Beeks' balance sheet from that time was that trade payables seemed like a large figure for a small company:

But how should investors put these figures into context? Larger companies will tend to have more significant balance sheet entries. The key thing to note is that invoices have an expected timeline for payment. For commercial suppliers, these are normally 90-day terms. So, working out how quickly a company is paying its bills (on average), rather than the absolute value of those, may give a clue as to whether it is in financial distress. This measurement is known as Days Payables Outstanding. This is calculated by comparing the trade payables figure to the Cost of Goods sold over the previous 12 months since this is the amount suppliers will have invoiced. Here is the formula:

Days Payables Outstanding (DPO) = 365 x Accounts Payable/TTM Cost of Goods Sold (COGS)

For the year ending the 30th of June 2021, Beeks Financial Cloud (LON:BKS) COGS was £6.59m, and trade payables were £2.54m, making the DPO 141 days. This is higher than standard commercial terms. There may be many explanations…