I hope everyone has had a wonderful Christmas break. I’m away in Australia visiting my in-laws and being topsy turvy for a while has offered me a chance to gain some perspective on these difficult markets. As is usually the case, my confidence is best found through number crunching. So this Boxing Day I’ve run the gamut on the last 50 to 100 years of stock market history to develop a statistical model of stock market returns. If you read, scan and ponder this piece you’ll have a far more rational understanding of the range of possible outcomes for 2019 and beyond. :-)

The range of the study

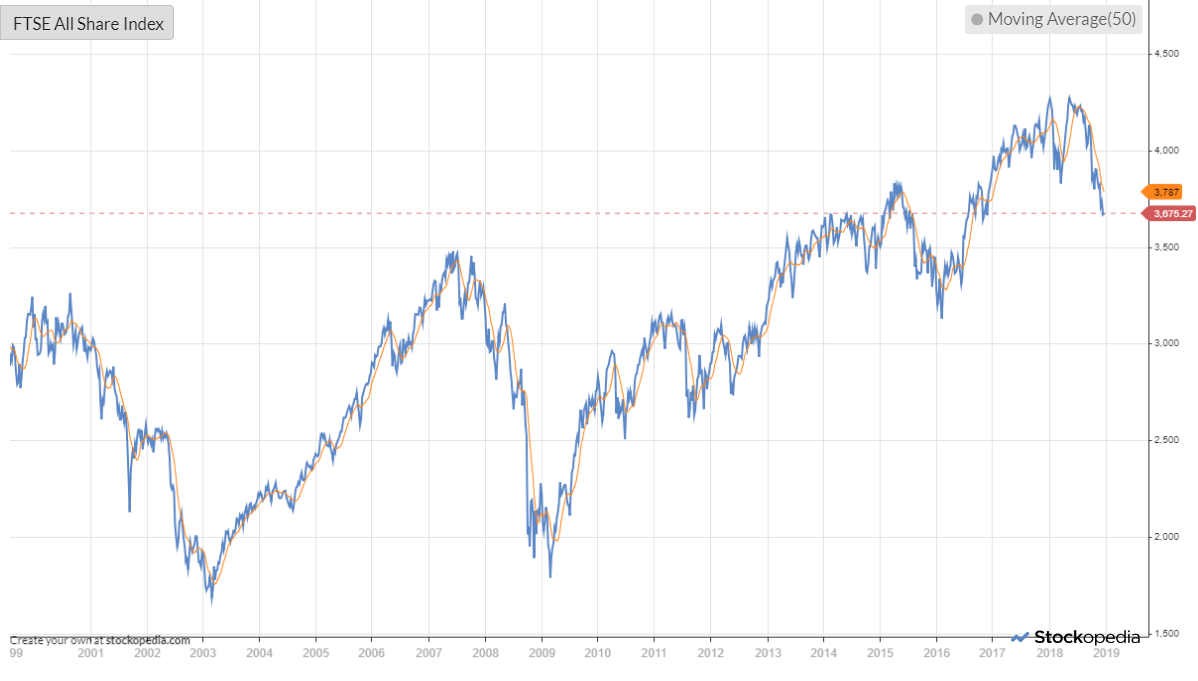

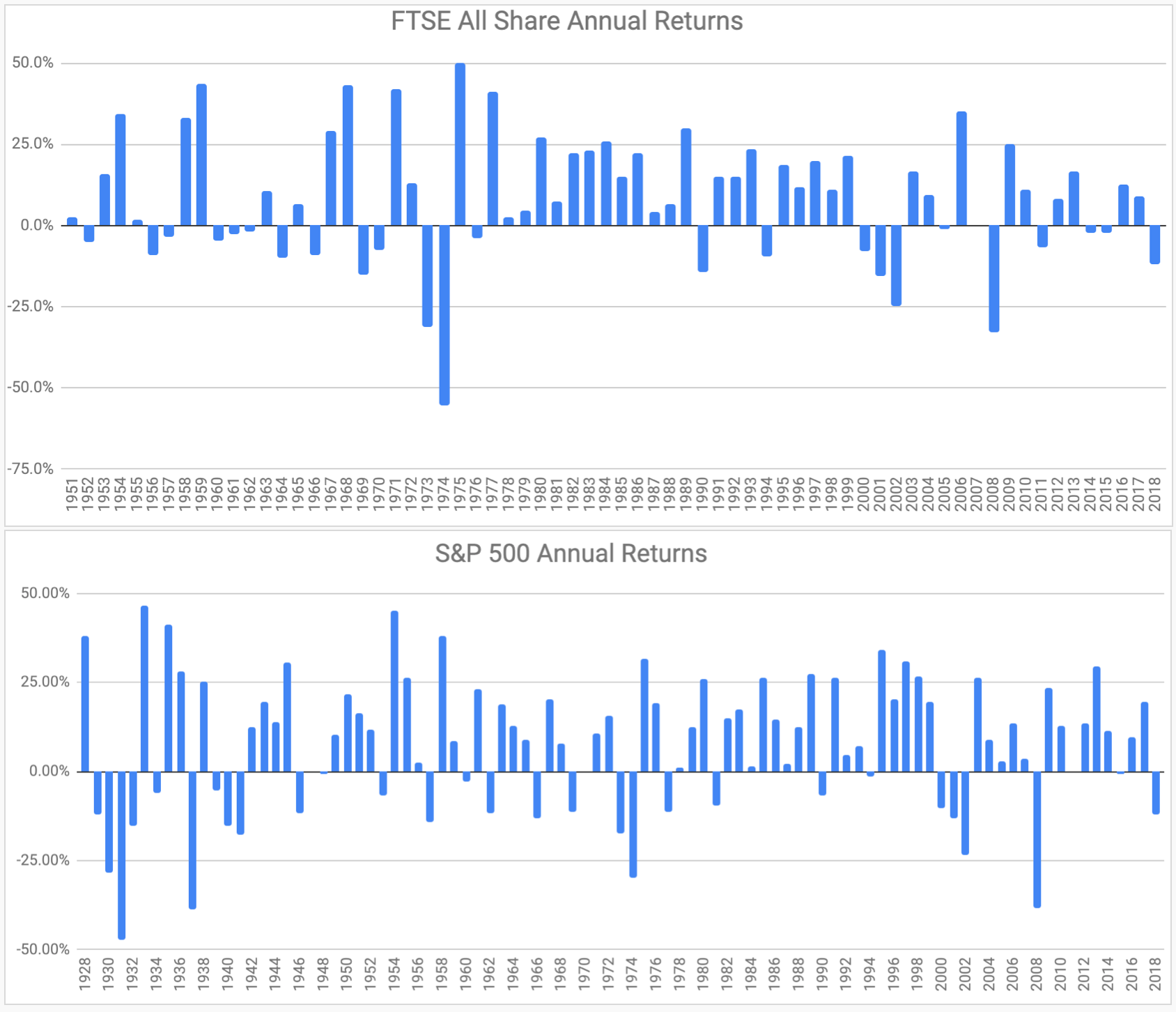

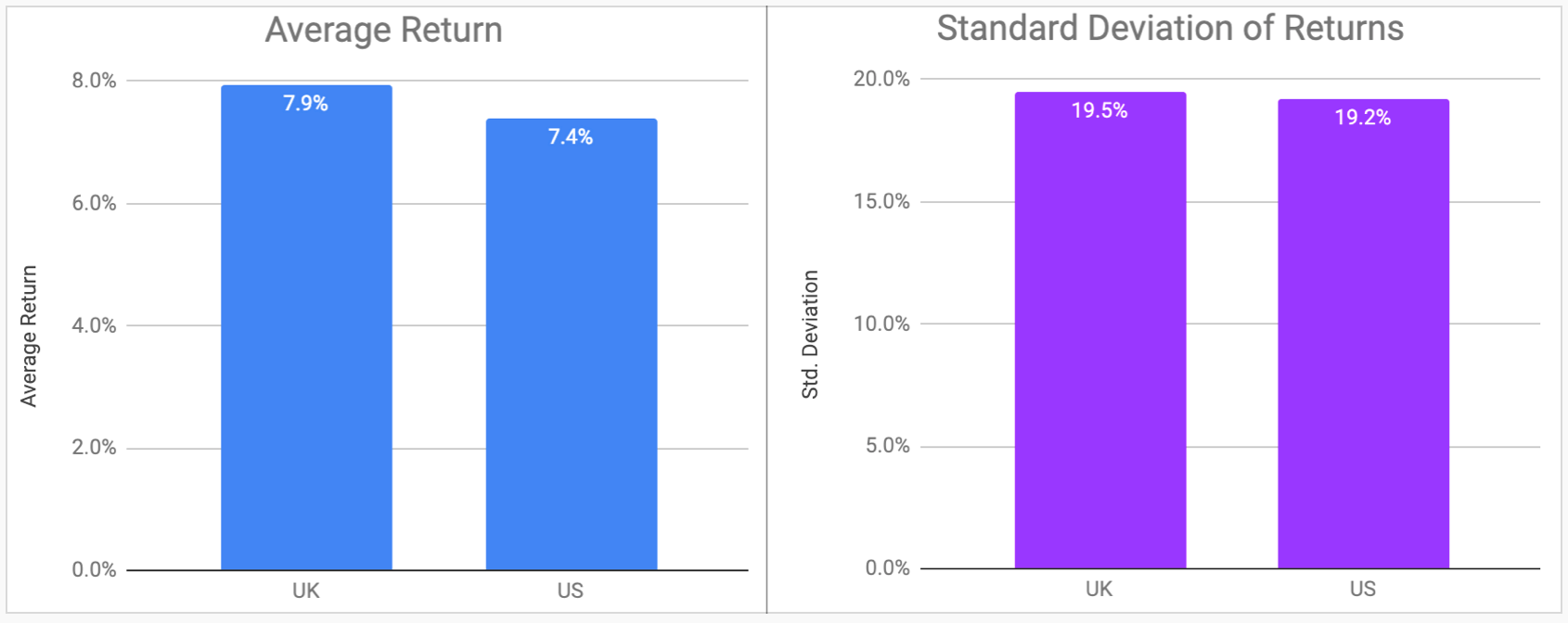

I’ve gathered as much stock market history as I can get my hands on for both the UK and the US stock market. I’m using 68 years of “FTSE All Share” data as the proxy for the UK, and 90 years of “S&P 500” data. Now the more knowledgeable of you will realise that the FTSE All Share was initiated in 1962 and the S&P 500 in 1957… so these time series have been extended through some additional digging and data munging. I apologise to anyone who is a purist, but from my perspective (as an armchair statistician), the more history the better. We end up with a pair of annual time series as follows. (Please note these are capital gains only and do not include dividends).

The average stock market return

We aren’t comparing like with like (as the UK data set is a lot smaller), but equities tend to behave very similarly across both sides of the Atlantic. The average annual return over the whole series is a healthy 7.5%, while the standard deviation of return is plus or minus 19% around this average. For those who don’t remember their school maths, this means that it’s ‘standard’ that roughly 2 in every 3 years the stock market will return somewhere between +26% and -11.5%. The FTSE All Share & S&P 500 are both down about 13% year to date… so they are just outside this standard range. I think we all forget that stock markets can be quite volatile - but it’s par for the course!

How often is the stock market up, and how often is it down?

When stock markets go through…