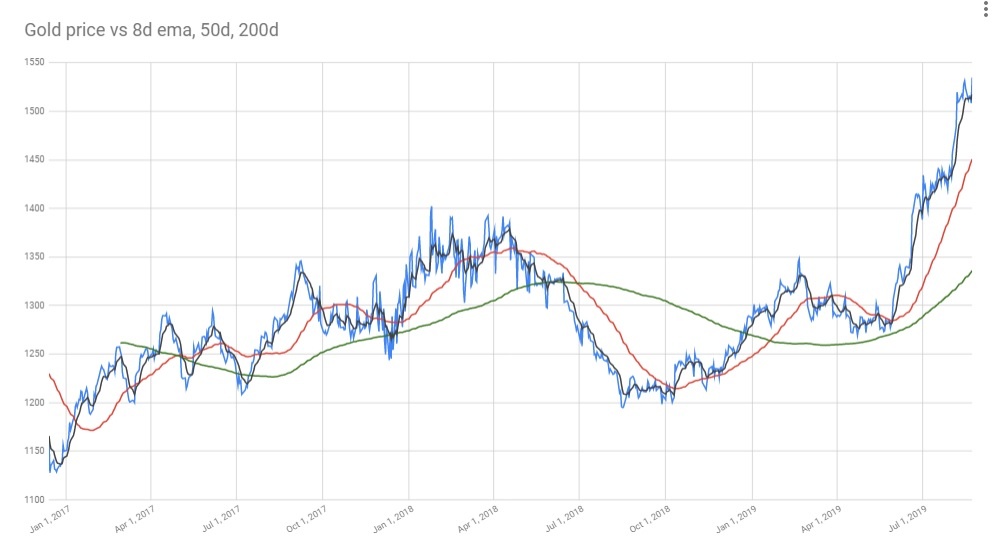

Gold continuing its march higher... with a lot more to come IMO.

Is benefiting from being the ultimate safe haven in a time when...

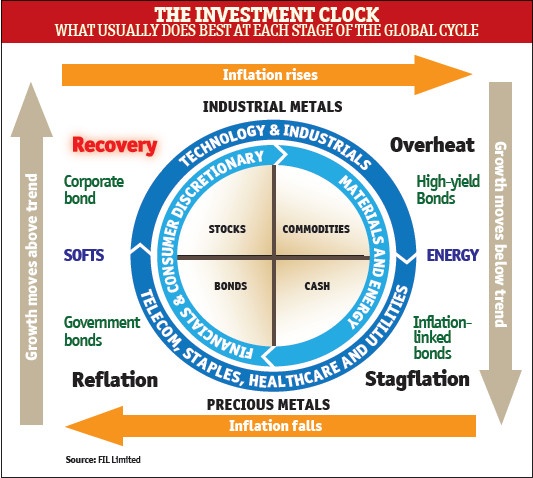

- The global economy is slowing

- The value of USD is set to drop as US enter rate-cutting cycle

- Stock markets are looking toppy

- Long term government bonds are paying negative yields

- Many nation states (led by China) are buying/stockpiling gold at the moment

All in all i see it not only is a great hedge against a stock market correction, but as a great investment in its own right at the moment.

As you can see from the 15year chart the trends, once established, tend to last years...

My portfolio is currently 50% long, 10% short, 40% gold

Below are some of the gold funds/stocks i've got at the moment. The individual stocks could in theory produce better returns than purely betting on the the price of gold, but obviously carries greater risk - hence i prefer buying leveraged ETF's rather than individual stocks

- SG Gold Daily x5 Leveraged

- Boost x3 Gold Daily Leveraged, choice of USD or GBP

- Direxion Daily Gold Miners x3 (also offer a Junior Miners)

- VanEck Gold Miners ETF (also offer a Junior Miners)

- Acacia Mining (note: just received a takeover offer from Barrick this morning)

- Barrick Gold

- Trans Siberian Gold

Anyone else buying/accumulating gold at the moment or have any views?