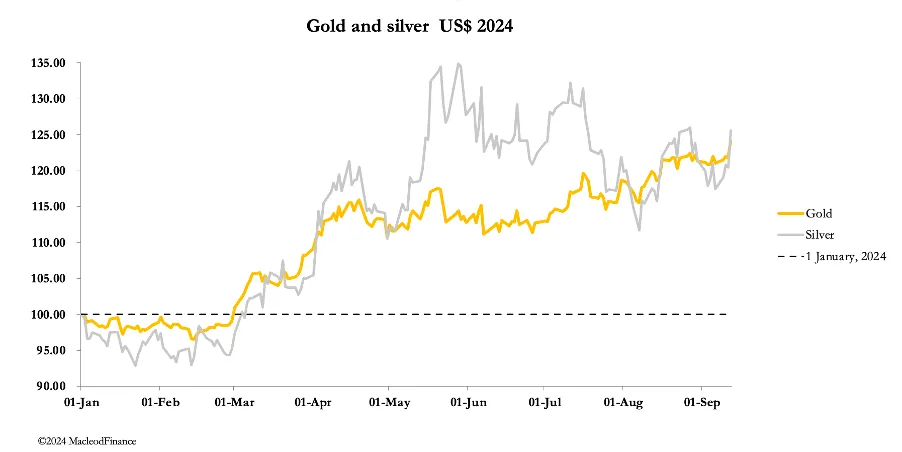

The technical action of Gold looks constructive under all time highs, in conjunction with numerous positive fundamental drivers.

Gold on the daily chart displaying a characteristics of a 'volatility contraction pattern'. Higher lows, tightening price action, several bounces off the 50d SMA (purple MA).

GLD (proxy ETF) multi-month consolidation under ATHs, and in the last 4-weeks or so displaying 'VCP' characteristics.

Gold Futures (GC) 12+ year Cup with Handle breakout on volume earlier this year. If you're familiar with the Law of Cause & Effect in financial markets, that's an almighty causality.

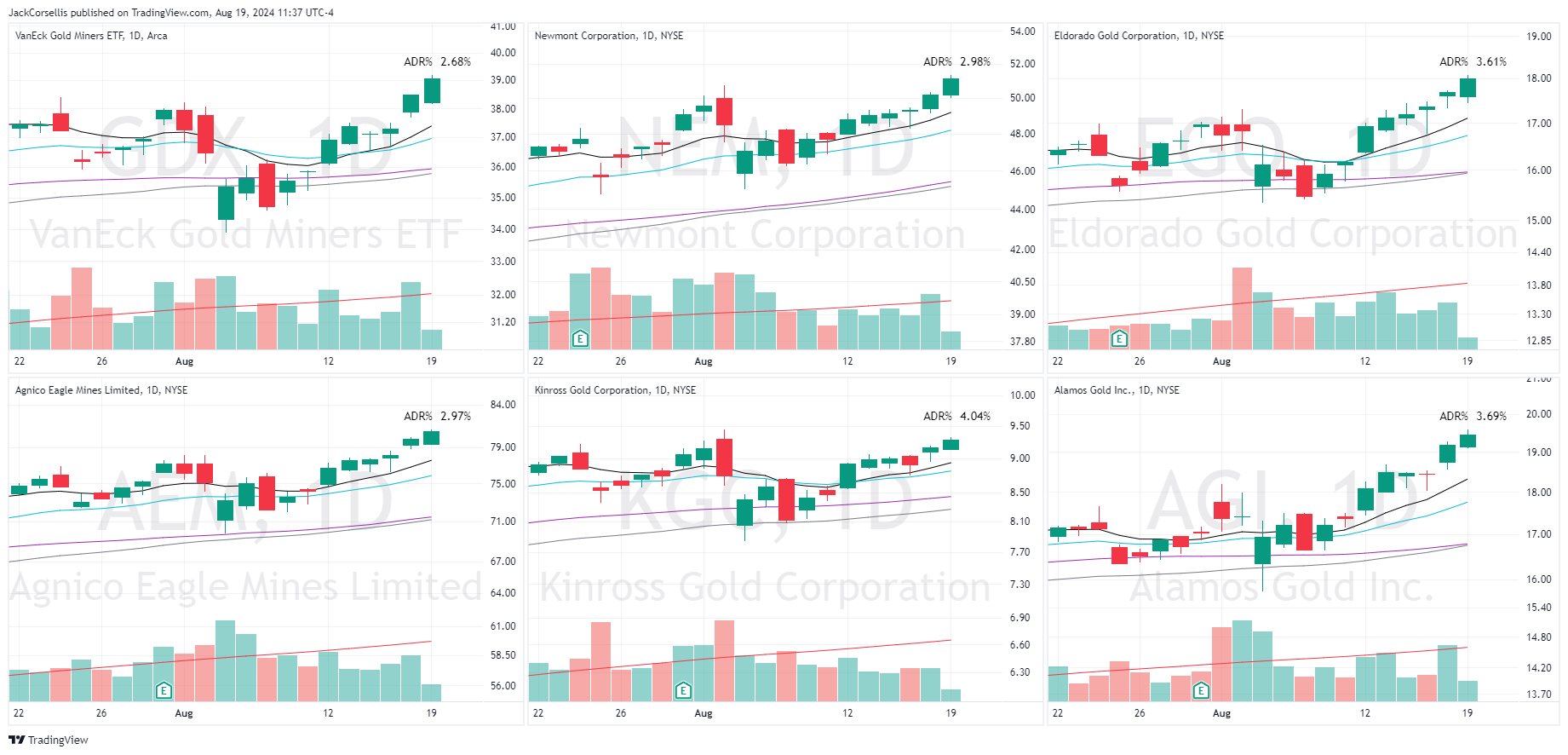

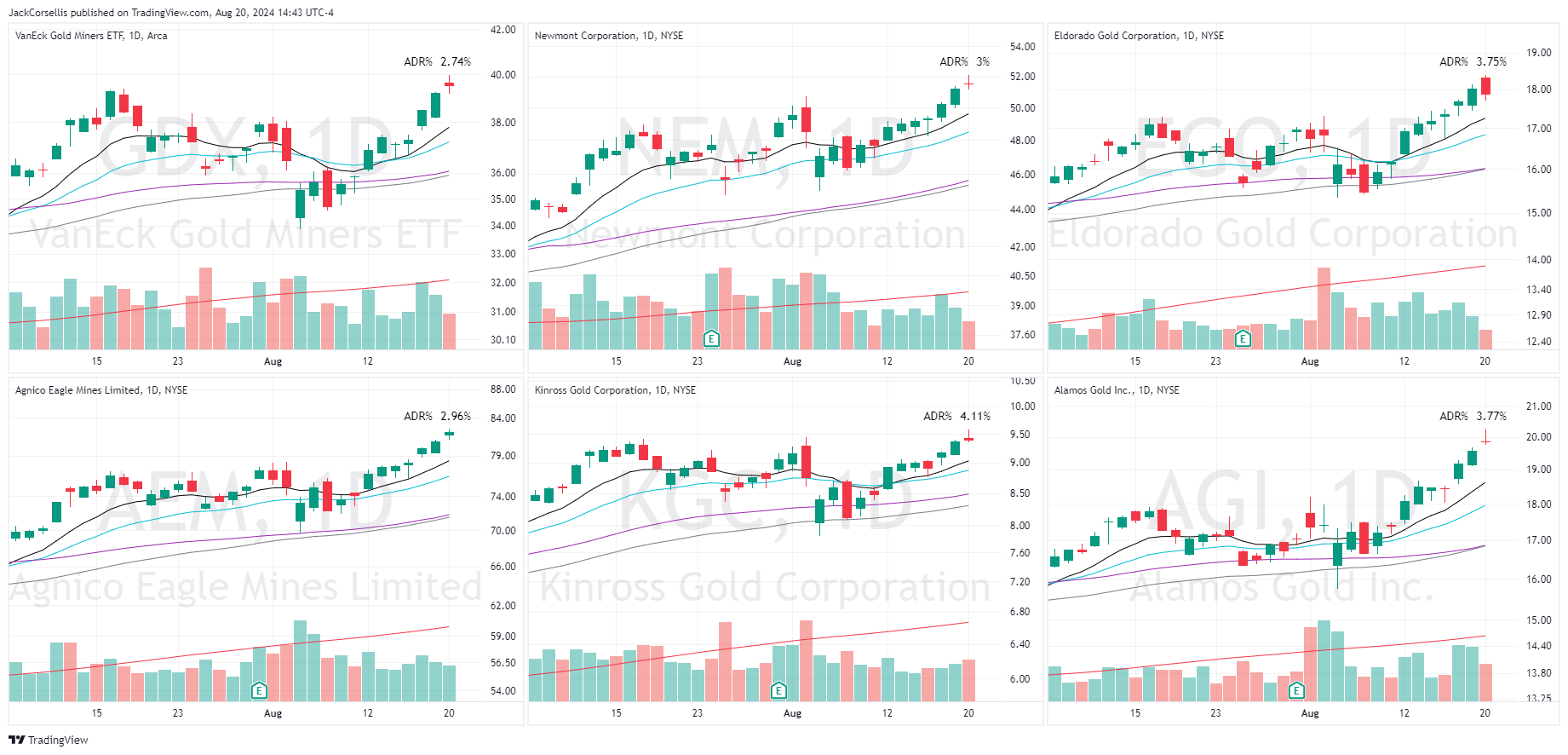

Gold Miners currently building constructive continuation bases, in my view, as is the group ETF VanEck Gold Miners ETF (PCQ:GDX).

Several precious metal miners below high on my radar and/or I have long positions at the time of writing, including: Newmont (NYQ:NEM) Eldorado Gold (NYQ:EGO) Agnico Eagle Mines (Ontario) (NYQ:AEM) Kinross Gold (NYQ:KGC) Alamos Gold (NYQ:AGI) Harmony Gold Mining (NYQ:HMY)

Talk of potential acquisitions too, with junior miners getting acquired by the larger cap stocks in the group such as Barrick Gold (NYQ:GOLD)