There is a notable rotation into value in Japan right now.

If you have some spare Yen and are hunting for high probability entry levels on > 3% DY stocks.... Japan is currently screening well for:

- Very weak longer term price performance eg , eg, 3 year RoC < 15%

- Dividend Yield > 3%

- VR > 85

- QR > 50 (or what ever you want to use for your Q definition. Maybe RoE>15% and NG<50% ???)

- Dead base with relatively narrow 52 week H-L range (optional, can be tricky)

- A small squirt in momentum out of a dead base, eg Price above 130 day MA and a 1 month RoC > 5%. Intentionally small for a wide net to get some subtle fish.

Then, manually-human screen each candidate for:

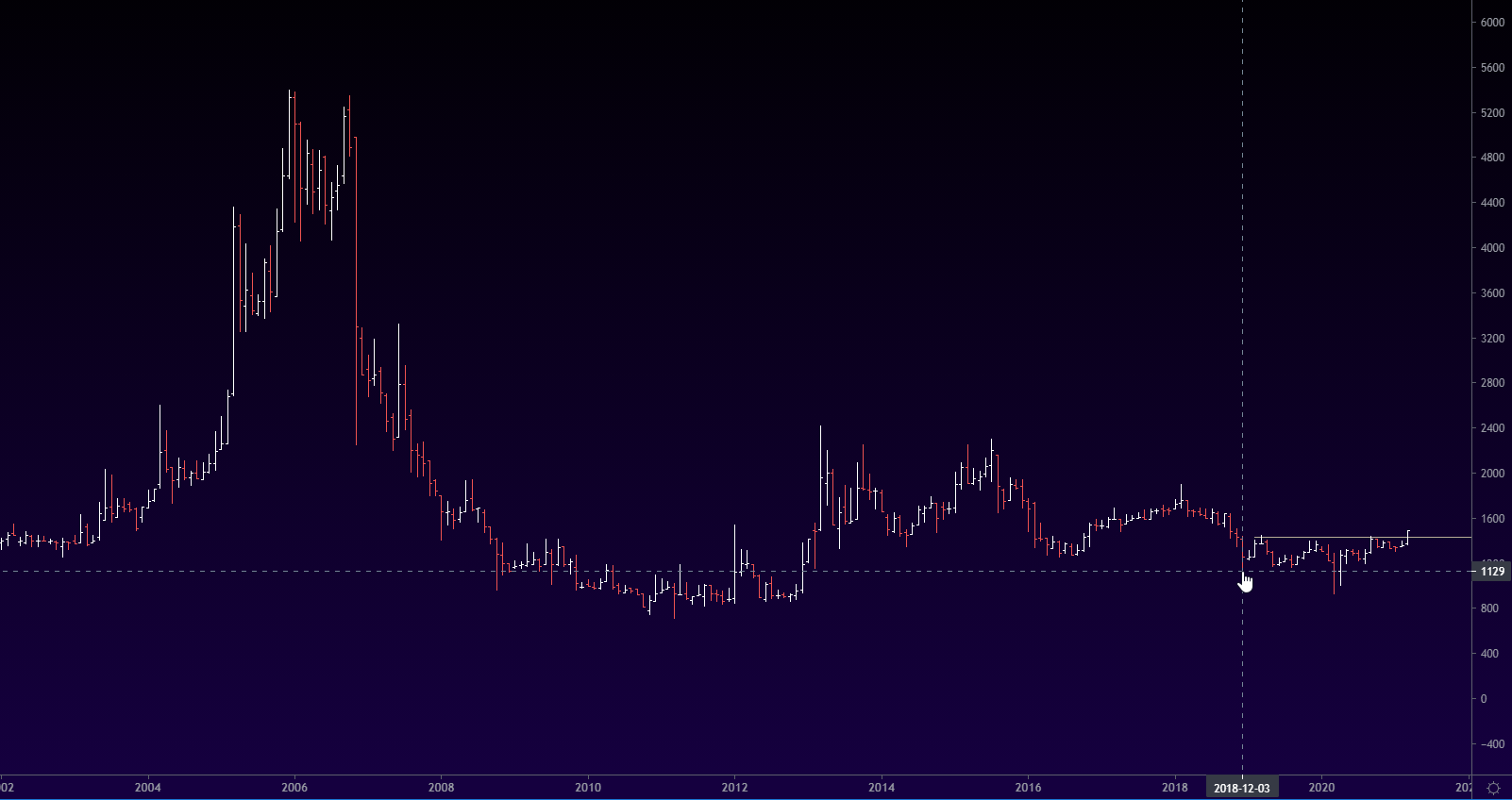

- A "nice" looking monthly chart... near all time lows, or near a long held long term base of range, a bending turn up out of that etc

- A significant earnings release supported by a sales increase (or guidance upgrade, hard to find and read) that coincides with the "small squirt in momentum out of a dead base" on a weekly chart. Note: I DO NOT screen for this in the machine-screening stage... it is just too nebulous (example among shortcomings: cant capture big negative to positive EPS swings, which are common after the Covid earnings holes out of which many companies are now rapidly climbing)

- With a surge in weekly volume to accompany the decisive break out on earnings (again, don't machine screen for this, do it manually to capture the variations in form with some human fuzzy logic)

This will find some apparently dependable quality companies that are grossly undervalued and trading at defendable low price levels offering maybe high probability entry levels. Note the low price levels often are defined by the aggressive Mar2020 Covid low being retested a few times consequently. These should be strong bases. Then, with earnings catalyst, the stock woke up and popped out into what could be the very first move in a new up trend. Some are taking off from there without a pull back. But to further refine the high probability entry, I'd wait for a PB to the 10 week ma, or near there. Or the anchored VWAP from the low of the week that started to price break out. Or a pullback to the support level that previously defined the top of the dead range...…