International Business Times Video link (click below):

Goodbye Labour mansion tax, hello Tory post-election property bonanza at

Berkeley and Foxtons

Could property be the big gainer from David Cameron's election win? Estate agent Foxtons and house builder Berkeley Group jumped 9%+ on 8 May. But why?

Clearly, the stock market has heaved a huge sigh of relief at the demise of the Labour Party. Now there is no fear of a mansion tax hitting London housing.

This is good news for house buyers at the £2m ($3m, €2.7m) plus price bracket, such as foreign buyers in London, who have been holding off any purchases up until now.

Equally well, with the risk of Labour's threatened rent controls now removed, the buy-to-let market could now see renewed activity.

Now that the Tories are in sole charge, they need to urgently tackle one of Britain's most pressing problems. London and the South East is the UK's economic heartbeat, but is desperately short of affordable housing.

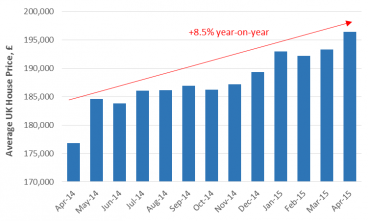

House prices still on the rise – outside London

The Halifax house price index rose 1.6% between March and April, and 8.5% over the last year, for a yearly gain of nearly £20,000 on the average house (Figure 1).

Figure 1: UK house prices up by nearly £20,000 over the last year

Source: Lloyds Bank

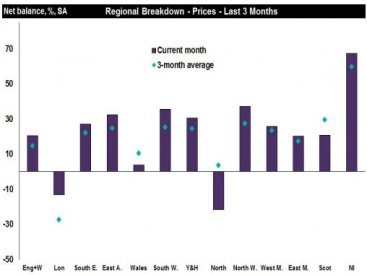

Last year, London properties saw the fastest-rising prices. In contrast, it is the rest of the UK that has enjoyed stronger house price momentum over these last 3 months.

According to the Royal Institute of Charted Surveyors (RICS), London is one of the very few regions where house prices have actually fallen over the last 3 months (Figure 2).

Figure 2: House prices rising fastest in Northern Ireland

Source: Royal Institute of Chartered Surveyors

Four factors should drive a rebound in buy-to-let house purchases:

- Lifting of the threat of rent controls;

- High demand for rental properties (Figure 3);

- Falling mortgage interest rates: The Co-Op Bank are now offering a new 2-year fixed-rate mortgage at only 1.09%. This suggests that the first sub-1% mortgage rate could soon be here.

- Falling savings rates: your saved cash is worth less and less in the bank, increasing the attractions of alternative income investments.

Figure 3: National rental demand remains very high