Grainger is the UK’s largest listed residential landlord and has historically focused on reversionary residential property. A new five-year plan will accelerate a shift towards the UK’s private rented sector (PRS). This will increase Grainger’s rental income, allow for dividend growth and should reduce the discount to asset value.

Recent buy-to-let tax changes in the UK have made it a less attractive area for individuals to invest in. It is, though, easy to see why individuals invest in residential property given the vagaries of the UK stock market.

A flat in London should increase in value over the long-term while paying out rental income. This is because of constrained supply, given that there is only a fixed amount of land in the centre of a city, and growing demand.

However, it is worth considering stock market alternatives and Grainger is the company that most readily fits the bill. In January the group’s new CEO Helen Gordon announced to boost its position in the UK private rented sector (PRS).

Grainger: shifting towards the UK Private Rented Sector

Source: Grainger January 2016 strategy presentation

Over the next three to five years the company is set to invest £850m in UK PRS assets to “drive rental income growth.” The target looks to be easily achievable given that we have seen two announcements on PRS acquisitions in February.

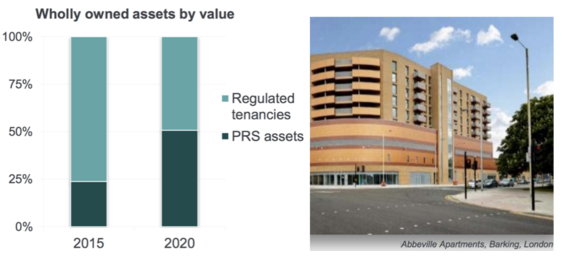

The first is for £100m in Salford (Manchester) and the second is for £57.3m in West London. Grainger is hoping to have half of its assets by value from the Private Rented Sector by 2020.

This shift will support dividend growth as rental income forms a greater proportion of total profits. It will also mean that Grainger is more of a listed “buy-to-let play” on UK residential property.

The business is currently driven by regulated tenancies that are set below the market rental level. When they become vacant full control reverts to Grainger with the properties sold on the open market.

Case study: Spectrum apartments, Liverpool

As a case study in how PRS investment can work out the group has highlighted the Spectrum apartments in Liverpool. This was bought by Grainger for £2.7m in December 2014 and £0.25m was spent on refurbishment.

At September 2015 the apartment block was valued at £3.4m given the group a 15% uplift on the total cost of £2.95m. The annual rent at £248,000 gives an 8.3% gross yield on the total cost of purchasing the apartment…