Well, today sucked.

Indivior, as some predicted, tanked on its rival getting FDA approval. Those who said that I should have done more research on it have every right to gloat, but I stand by my decision. This is portfolio is designed to take the human bit out of trading because I know I’m not good at making those kind of calls. It is the price I pay. That said, I’m quite relieved in my prior post I set up a ‘paper’ stoploss for my paper portfolio of 10% in a day, allowing me to offload this share.

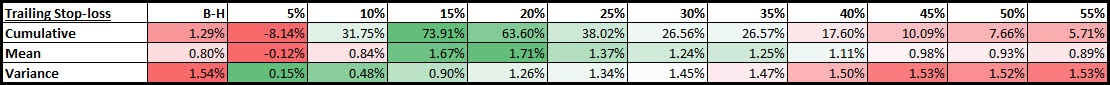

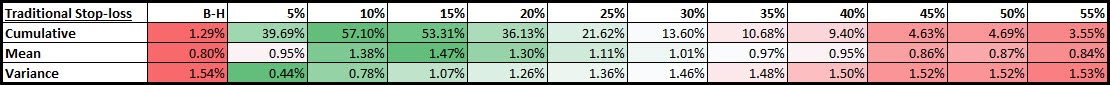

Learning point: I need to firm up some trailing stop loss rules

Other updates

Royal Mail shares also took a hit after a not so great trading update. It’s one week movement dropped 13%, so was cut. The majority of my holding was still up 20%, but a more recent top up lost 7%.

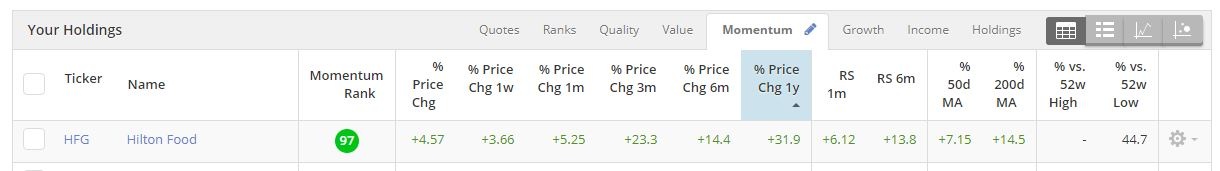

At the beginning of June I bought into RM at 226p. This was one of my earlier momentum quality focused picks, with quality at 81, value at 68, and momentum at 97.

Picton was sold shortly after as its quality rank dropped below 40, banking me about 7%. Camellia went next (down 6%), along with Ocean Wilsons Holdings (down 4%). These last two have been an experiment on stop losses. Based on a suggestion by a commenter, I’ve been mulling over the idea of graded stop losses, based on risk rating. Provisionally:

- Conservative stocks – 5% trailing stop. Or drop of 5% over the last week/month

- Balanced and adventurous – 8% trailing stop, or drop of 8% over the last week/month

- Speculative – 10% trailing stop, or drop of 10% over the last week/month.

Unlock the rest of this article with a 14 day trial

Already have an account?

Login here