Within three weeks, the UK could have a new government. Parliament has already been dissolved and Britain will go to the polls on 7 May. Immediately after the last general election, the FTSE 100 fell by nearly 11%, as the major political parties vied to form a coalition government. Political uncertainty was not good news for markets back in 2010, and the 2015 election results could usher in another period of uncertainty.

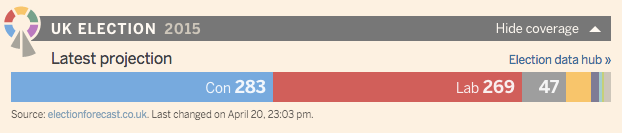

A recent poll, published on the Financial Times website, predicts that the Conservative and Labour Parties will secure 283 and 269 seats respectively (see below). This could mean that neither Mr Cameron nor Mr Miliband will be able to form a government with an absolute majority. Another coalition government - with either the Lib Dems or the SNP - could well be on the cards.

What will this mean for investors?

A coalition government could make investors nervous. The Lib Dems have revealed plans to increase the capital gains tax paid on shares from 28% to 35%.

A successful Conservative showing at the election could also spell a period of uncertainty for markets, given that Cameron has promised to hold a referendum on Britain's EU membership.

Furthermore, Mr Miliband has threatened to break up the 'big five' UK banks, and freeze gas and electricity prices until 2017. This could spell bad news for FTSE 100 giants, like SSE and HSBC.

Will the market overreact to this uncertainty, and could that present buying opportunities? Let's take a closer look at SSE and HSBC. Both companies qualify for Stockopedia's GuruScreens.

HSBC (HSBA)

HSBC qualifies for the Dividend Dogs Screen. To qualify, a company must have one of the highest dividend yields in the FTSE 100. HSBC supported a 5.3% yield in 2014 and is expected to support a 5.7% yield in 2015. However, it must be noted that HSBC has underperformed the market by 6% over the last twelve months, as earnings fell by 12% in 2014. At the extreme, HSBC could , be a dividend trap - a company that pays…