Last year I reviewed my portfolio for 2018-‘Marched up to the top of the hill and down again’. it was meant to encourage investors, after a difficult year, to ‘soldier on’. The FTSE 100 is still 144 points(2%) below the level it was on 1st January 2018 so 2019 merely retraced some of the 2018 losses. No wonder even experienced and successful investors feel that it has been a disappointing two years. We all need a little encouragement, I had more than a decade learning (painfully) about investing which fortunately coincided with the Thatcher era when the generosity of the privatisation schemes masked my own losses due to inexperience(some) and incompetence(lots).

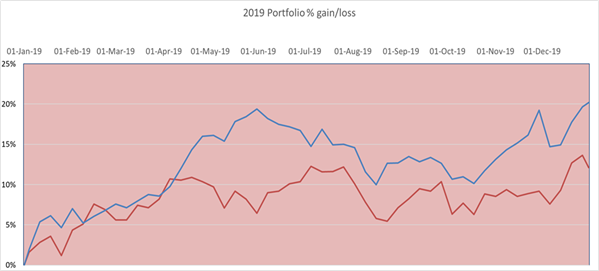

In 1992 I left the Army and felt I had a responsibility to my family to invest methodically and I have subsequently managed 15% annual portfolio returns, with a standard deviation of 15%. In 2018, against a difficult investing backdrop, I gained 5%. In 2019 I did a little better with 20.18%. The diagram below shows the portfolio in blue and the FTSE 100 index in red throughout the year with weekly datapoints.

I’m frequently asked what is my timeframe and why the FTSE 100 as my benchmark. My parents were born in the 1920’s and latterly I managed their investments and avoided IHT on a seven figure portfolio using business property relief from AIM shares that was largely handed onto their adult grandchildren. I was born in the 1950s and my grandchildren will hopefully still be benefiting from my investments into the 22nd century. So I like to look at many decades as my investment timeframe and helpfully The Credit Suisse Global Investment Returns Yearbook 2019 of UK equity returns has a long timeframe which I can take as a guide. It suggests that from 1900 to 2018 the UK market returned 7.2% real returns with a standard deviation of 19.7%. Of course the study looks at ‘real returns’, that is after inflation, while my returns are not inflation adjusted but I focus on both outperforming the market by a few percentage points and doing so with a little less volatility, both measures are equally important to me. The FTSE 100 is my benchmark because that is what I could earn, less modest expenses and slippage, without taking any interest in investments

Modest outperformance is in my view within the…