Something happened in June

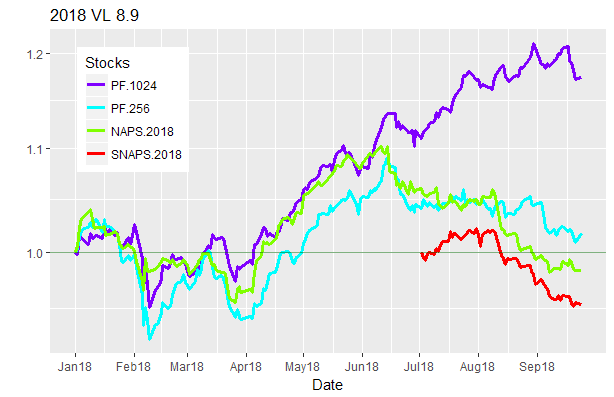

Many of us running a rules-based portfolio have noticed a recent slump in performance since June which has also afflicted the NAPS portfolios which are well documented on this site. NAPS portfolios have performed well over the last few years, but this year something interesting has happened, as illustrated in the graph below.

This graph shows the 2018 NAPS and SNAPS portfolios (together with two rule-based portfolios called PF.256 and PF1024 which we will discuss in a moment.)

All portfolios perform in a similar way until about mid-June. But then the NAPS portfolio and PF.256 start to decline while PF.1024 continues to improve. When the SNAPS portfolio is created it tends to follow a similar path to NAPS and PF.256.

So obviously the question is:

How are the two PF portfolios constructed and what is the 'secret' ingredient in PF.1024?

The answer is that each PF portfolio selects the 20 stocks on January 1st 2018 which had the best Sharpe Ratio. But PF.256 computed the Sharpe Ratio over the previous 256 working days (about 1 year) and PF.1024 computed the Sharpe Ratio over 1024 working days (about 4 years).

The Sharpe Ratio can be thought of as a risk-adjusted momentum measure. Alternatively, it computes a value which is proportional to the probability that the stock's annual return will exceed a target rate (in this case 25% p.a.) Another way to look at it is that it is a "momentum plus quality" measure since the risk adjustment tends to penalise momentum which is not backed by quality. Or yet another view is that we are looking for stocks on the efficient frontier as defined by Modern Portfolio Theory.

How repeatable is this effect?

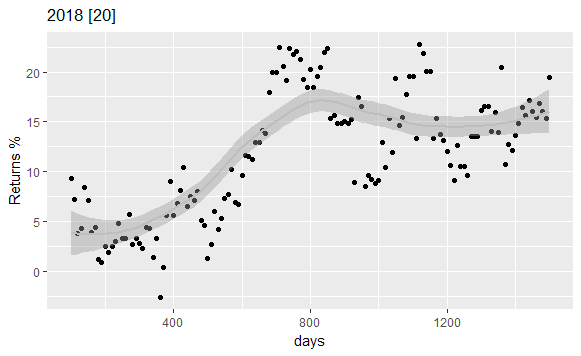

The initial conclusion might seem to be that it is better to compute the Sharpe Ratio over longer periods than one year. We can test this by sweeping the period over which the Sharpe Ratio is computed from 100 days to 1500 days and plotting the results.

The grey guideline shows the trend of the return as the number of days is increased. It looks as though there is a step change somewhere around 600 days. So do we have a quick and easy way to improve returns?...

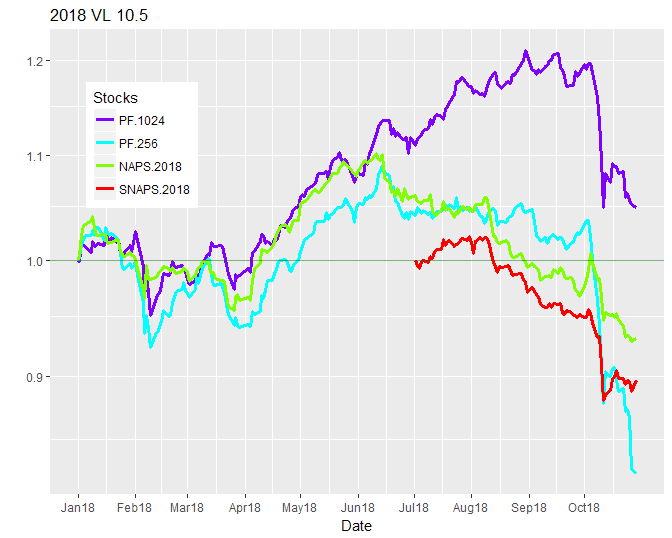

Unfortunately there is a catch!…

.jpg)