Havelock Europa is an international interior solutions

provider. It serves the Retail and Lifestyle, Corporate Services and Public

Sector.

The share price is dropping 17% today (which could change during the day), after the release of its annual results.

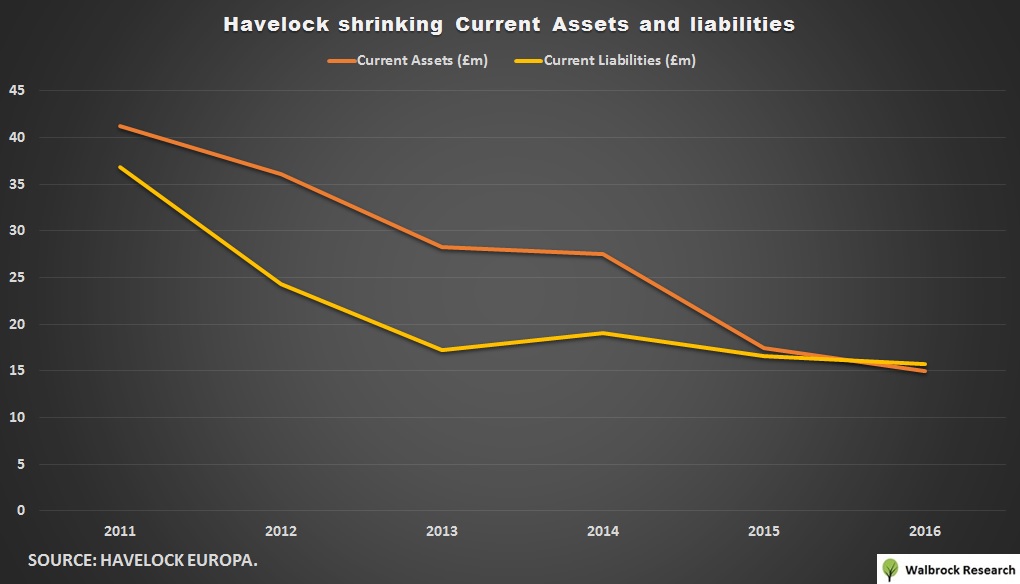

Finals Results

An interesting result as highlighted below: -

Take like-for-like sales growth of 21%. You would have thought the company achieved stellar growth. But revenue is £59.4m!

Before losing its financial services client, revenue was £73m in 2015. That client loss was a big loss.

Then there are three major three concerns for investors to digest: -

First, the company net asset per share has collapsed to 14.1 pence per share.

Two, it now runs net debt of £2.7m.

Three, the pension deficit rose to £9.4m from £1m, last year. So, where is the company going to find the money to plug the hole!

When Havelock hasn’t paid a dividend since 2009, there is no point in announcing a resumption to dividend payments. That won't happen!

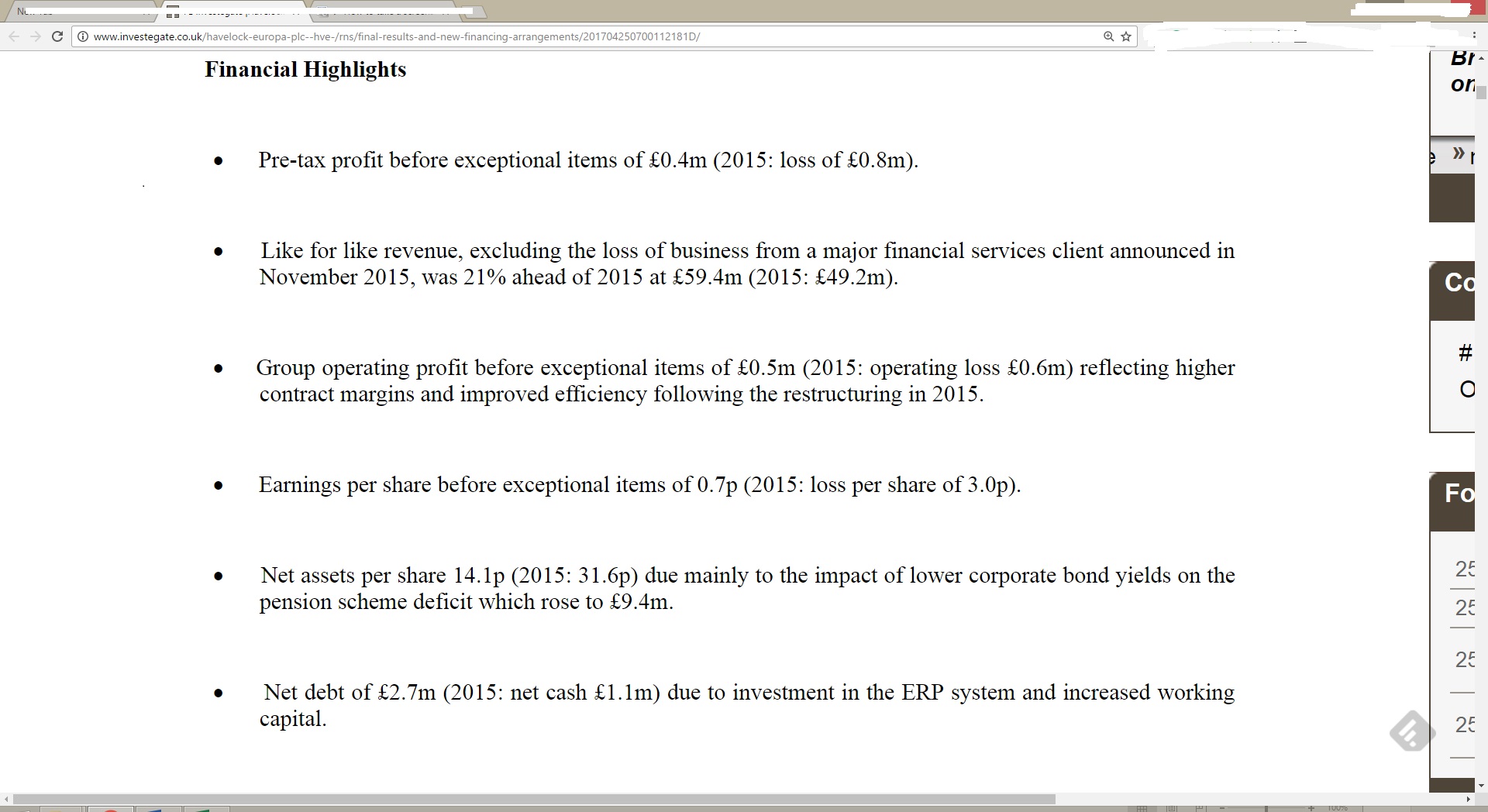

Below is a five-year summary of what is trending for Havelock.

Havelock Europa past five-years

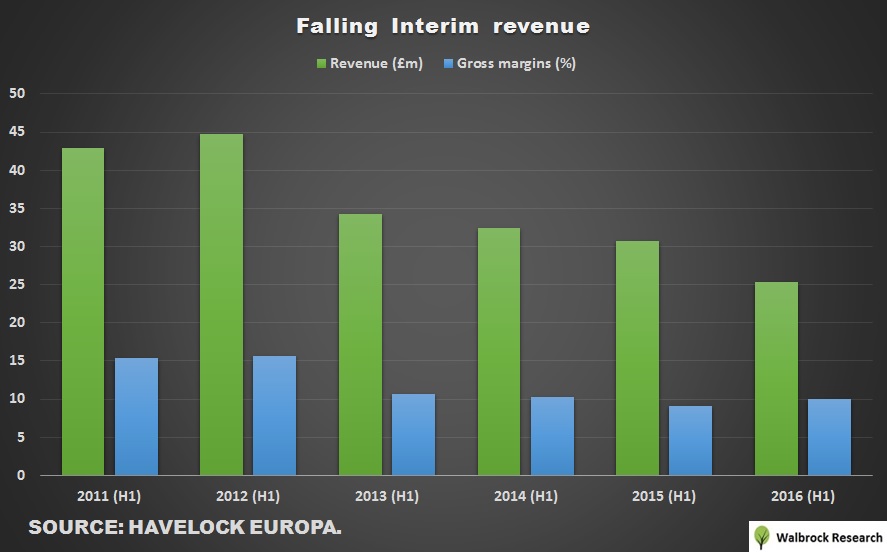

Havelock’s Profit and Loss

This mediocre company saw falling revenue in the last five years.

Compare

2012: £100m; 2016: £60m.

At the same gross margins fell by 500 bps. The slight fall in gross margins played a key and sensitive role in whether Havelock makes a profit or not.

Gross margin is the key indicator for this company. Because if it touches 14%+, Havelock is earning some operating profits.

When gross margin falls to 8.4%, then it turns into an operating loss of £5.4m in 2014.

Although the latest improvement may come a little too late.

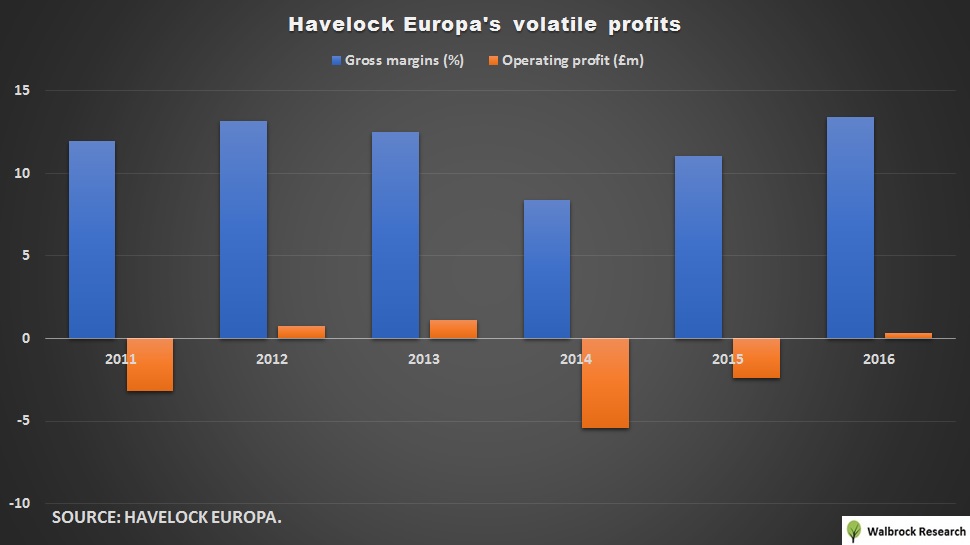

Havelock’s Balance Sheet

The biggest noticeable change is the company’s current assets

and current liabilities.

Current assets cover less than current liabilities. This is bad for a business not generating free cash flow.

P.S. Averaging £1m negative free cash flow.

Havelock’s cash flow

Apart from the dismal operating cash earnings, which have turned to a negative £2m. A pattern is brewing when the cash balance in the cash flow has gone into overdrafts.

Havelock Europa has made some great efforts to reduce its debts. Now, time is changing.

There is a convergence happening, as it has no choice, but agreed upon a new