TUI Travel (LON:TT.) and Thomas Cook (LON:TCG) have both been popular and profitable buys for investors since 2012, but the share prices of both firms have come off the boil this year: TUI is down by 12%, and Thomas Cook down by 35%, since the start of the year.

Both firms now look cheap quite cheap, with forecast P/E ratios of 7.5 (Thomas Cook) and 11.3 (TUI), but there are some big differences between the two firms -- and it's not immediately obvious which is the best buy in today's market.

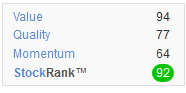

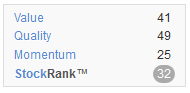

To get a clearer picture, I've used the Stockopedia StockRanks to compare both firms and suggest a best buy:

| TUI Travel: | Thomas Cook: |

|  |

TUI comes a clear first in every category, with an especially strong Value Rank of 94 and an impressive overall StockRank of 92, suggesting that TUI is a good quality business that's reasonably priced.

Thomas Cook is handicapped by its high debt levels and poor share price performance this year -- plus of course its recent lack of profitability (it hasn't made a profit since 2010).

The StockRanks are a great way to get an instant snapshot of a company's qualities and characteristics, but I believe you need to look a little more closely before you can consider making a trading decision.

Growth & Value

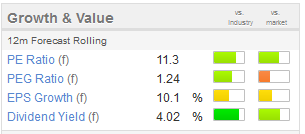

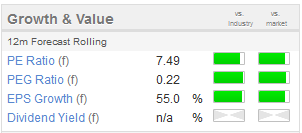

Stockopedia's 12 month rolling forecast provides a very useful snapshot of a company's valuation, based on the latest analyst consensus forecasts.

Here's how things look for

| TUI Travel: | Thomas Cook: |

|  |

Thomas Cook appears to offer better value, with a forecast P/E of just 7.5, and forecast earnings growth of 55% over the next 12 months.

However, it's important to remember that Thomas Cook's debt problems haven't yet gone away. Stockopedia shows net gearing of 920% for Thomas Cook, and even if the firm manages to hit its target net debt level of between £300 and £350m by the end of the year, my calculations suggest that Thomas Cook will still have net gearing of around 300%.

That's a lot -- and explains why the firm isn't expected to pay a dividend until next year, unlike its peer TUI, which offers a 4% prospective yield.

Reality check

Shares in both companies have fallen by more than 5% this week due to concerns that the Ebola epidemic could hit…