I have been working on the concept that it is the period and period return that is important not just the amount of profit. The results are interesting and worked on actual investment portfolios.

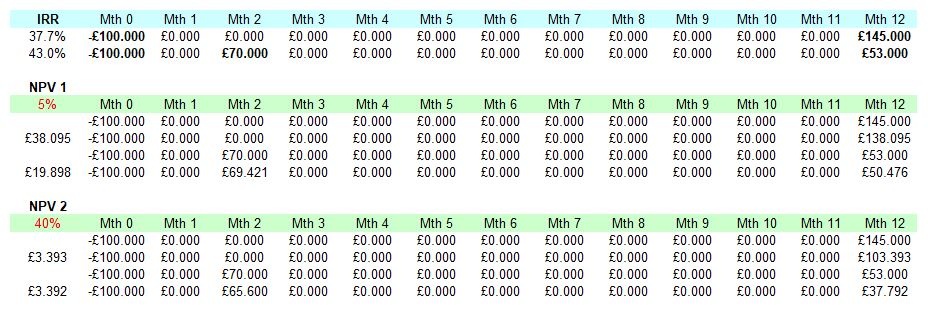

Here is the problem. Let us say that you invest £100,000 but you find that after an average of 7 weeks you are stopped out and are holding 70% of your original capital thus leaving 30% invested. Assume that you invested in ten £10,000 lots. At the end of the year the £30,000 is worth 100% more and you have had £70,000 back after an average of 7 weeks less any losses, shall we say 10% of the realised capital. If you had left the whole £100,000 invested it would be worth £145,000 because some of the losses either reduced or increased. Ignore what happens to profits because it is only the end value that counts.

Looked at simply you have made £45,000 by leaving it all invested and only £23,000 (£30,000 - £7000 ) by selling early but that is ignoring that the capital realised after 7 weeks is available for new opportunities. So how would you calculate the true value in order to give a fair comparison?

Obviously, these figures are for calculation purposes it is not a case of which is better but how would you prove it is better or worse? All thoughts gratefully received.

Sorry - could you say that again?

Are you trying to calculate the "expected return" (in the mathematical sense of average return) based on different stop loss rules and assumptions about the returns from reinvesting?