Introduction

(P.S. I’m not an I.T. person. But I’m here to review their financials!)

1Spatial plc is a leading software and solutions companies trading under the brands 1Spatial and EnablesIT.

What it does is they manage to interpret data for clients. To do this, they partner up with some of the leading technology vendors including, Esri, Oracle, and SAP.

Looking at 1Spatial over a four-year period, the business looks great (meaning I like the financials). It is growing in tech status, but what is bothering investors is the falling cash balance.

So, what is going on at this technology firm?

To make sense of this, you need to break down their financial step-by-step.

1 Spatial Profit and Loss

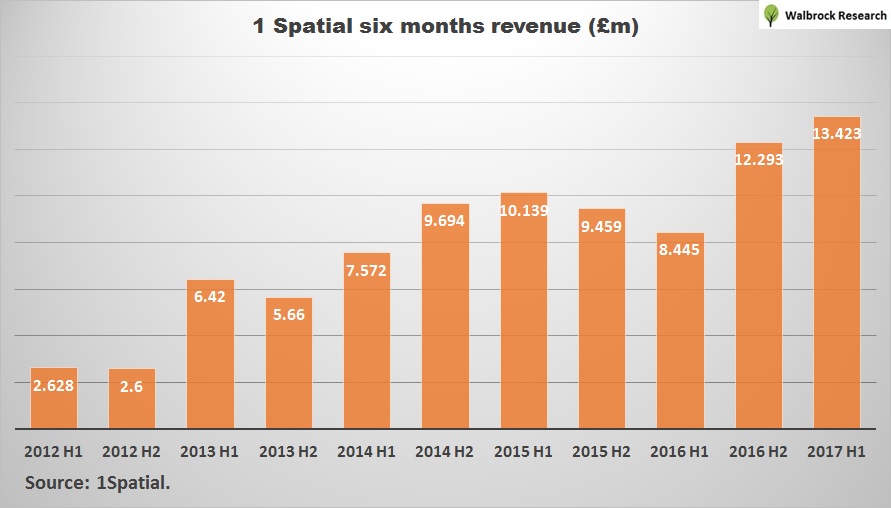

You can see it is making good progress on its sales generation. Here’s the breakdown for every six months.

Clearly, the business is growing their client base, as revenue jumped 300-plus percent in four and a half years. But, the downside is the accumulative operating loss of £12.3m!

So, what is the cause? Well, it isn’t coming from faster trade receivables growth.

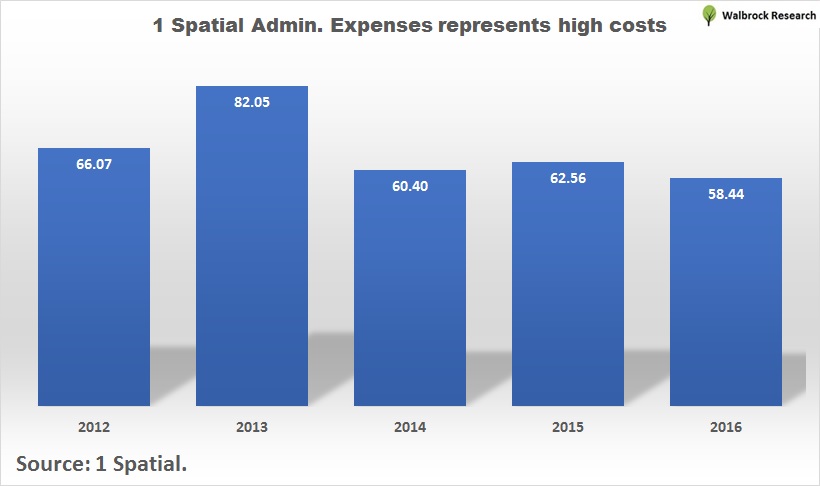

The culprit goes to higher admin costs.

1 Spatial admin costs accounted for between 58% and 82% of total revenue, which is really high. Let’s see why.

Employee costs too high

Here is 1 Spatial wage cost per worker: -

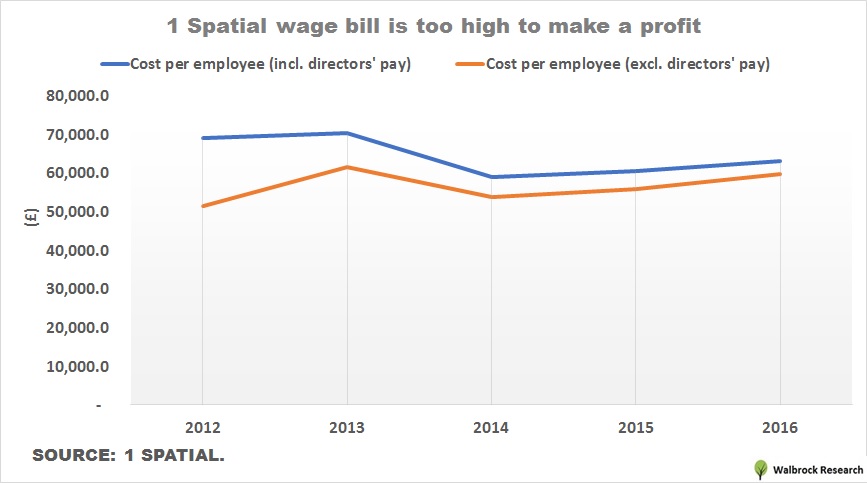

Given it is a small company, I include and exclude directors’ pay in two separate graphs to suss out if the directors were being overpaid. That isn’t the case! But, 1 Spatial is paying their staff a high salary.

There is a reason.

Business Insider has made a list on how much each tech firms in the UK pay their workers. Take Facebook from that list. They pay their employees an average of £70k, which incl. free food, business travels, gym allowance, etc.

So, for 1Spatial to recruit talent, it must offer a similar level of pay, despite being a minnow.

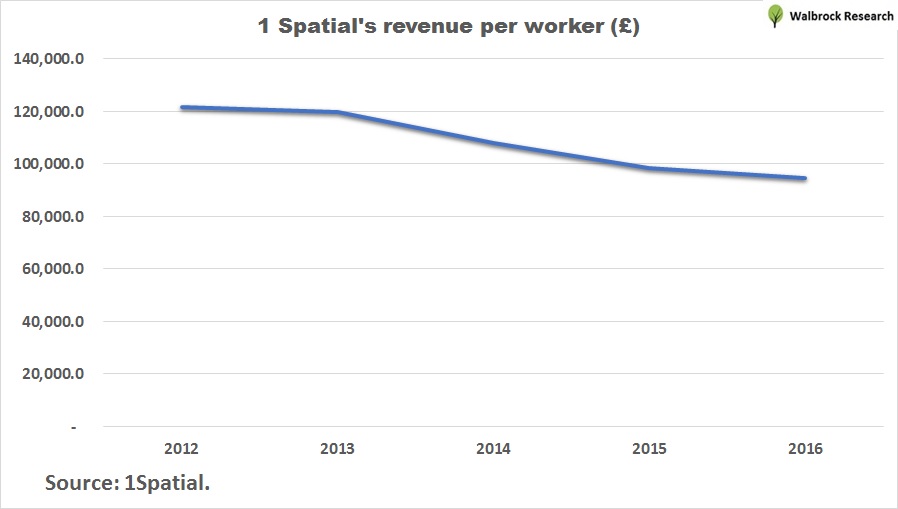

Has the high salary helped 1 Spatial to generate extra revenue per worker?

Sadly, not! In fact, the company’s productivity has declined from £120k in 2012 to under £100k.

1 Spatial Balance Sheet

One…