Continued from here. This series fell by the wayside since September, as I focused on a flurry of posts covering performance, a little shareholder activism, and some pretty exciting new stock buys/write-ups. Oh, and some bubble bursting..!

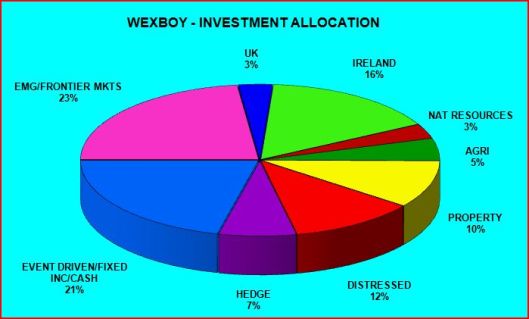

As a reminder: i) Asset allocation plays a far greater role in returns than perhaps we like to think – in this series I thought I’d try illuminate some of the logic behind my own portfolio allocation & stock selection, rather than individual stock picks, and ii) this portfolio allocation pie-chart might prove handy:

The prior Century post & Inflation post are v relevant too: They highlight why I believe inflation won’t prove an issue in the near/medium term, and how to prioritize the choice of real assets (property, natural resources, agri) as inflation pure plays. My expectation of delayed inflation, despite QE Infinity, has choked back my real asset allocation. Also, I consider many of my real asset holdings more special situations, than inflation plays.

Agri (5%):

Soft commodities/farmland are usually the last to substantially benefit when investors are fleeing inflation in earnest. However, the risk/reward of agri stocks is generally far superior than natural resource stocks. Particularly when one considers the low correlation to the economy/markets that true agri investments can offer – which I think argues for a constant agri allocation, regardless of inflation views. But find a great investment theme, and brokers/promoters are sure to ruin it! In a recent Agriculture ETFs post, I surveyed the gamut of closed-end funds, commodity ETF/ETNs, physical ETFs & stock ETFs – and found little opportunity. Mainly due to the lack of exposure to actual biological assets & growth – precisely the exposure you should actually seek out when making agri investments. We’re not talking processors or picks & shovels providers here – you really need:

Farmland, crops, livestock, dairy, forestry, plantations, chickens/eggs, fishing, aquaculture & water.

Farmland (& Crops/Livestock/Dairy):

Farmland’s the best agri investment you can make – it’s the ultimate store of value, and the No. 1 source for biological assets & growth! However… On the one hand, you have companies run from a financial perspective – the less said the better, these are usually promotional in nature & can be expected to lurch from one agricultural crisis/write-down to the next.

Most companies…