Remember this series? Yep, I’m spending an unconscionable amount of time getting through it. FFS, I started last June, promising a closer look at my portfolio construction, allocation & metrics. ['Hitting The Century' as it was my 100th post. And 'Pretty Panties' because I was so bemused by the prior response to the phrase]. Instead, you get a bloody epic – like The Hobbit. Oh well, blog rules…how ’bout I try finish by next June?!

Honestly, I expected it to turn out like this. But I’m delighted at the great reader response – I guess I’ve been trying (ad nauseam) to pound the message home that portfolio construction/asset allocation is just as important as stock-picking. [Studies suggesting asset allocation accounts for 90% of returns have been debunked, but more recent studies certainly confirm an average/minimum 50% of returns are derived from this source]. Unfortunately, this is forgotten/ignored by a lot of investors, even great stock-pickers… Admittedly, they may (occasionally) practice some kind of ex-post allocation – better than nothing, but an ex-ante approach is vital if you really want to end up with a safer, more diversified & higher return portfolio.

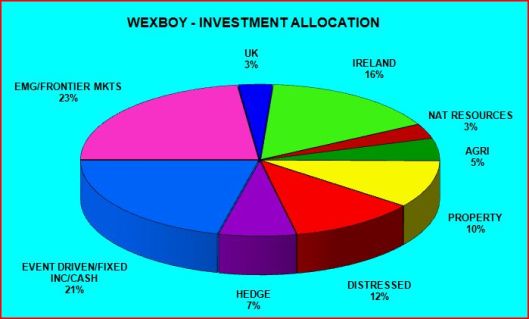

OK, let’s trot on – here’s a familiar pie-chart as a quick reminder (sure, it’s a little out of date – but have you noticed my portfolio turnover?!):

Distressed (12%):

This asset category remains unexploited by the majority of investors. I assume, first & foremost, natural investor optimism steers most people away. I mean, who really wants to invest in disaster? And why invest at all if you seriously think things are heading south? But I look at it v differently… First, I find distressed investors are laser focused on (discounted) assets – I’ve quite an affinity with that style of investing! Second, to avoid distressed investing is to miss out on i) a great portfolio hedge/diversification, and ii) perhaps an enduring source of potentially high return investments.

To explain, I need to expand on my idea of distressed investing. First & most obviously, it’s investing in distressed companies & securities. This is a specialist activity, and I’m happy to recognize my limitations – I prefer to invest via asset managers & investment vehicles. I’ve…