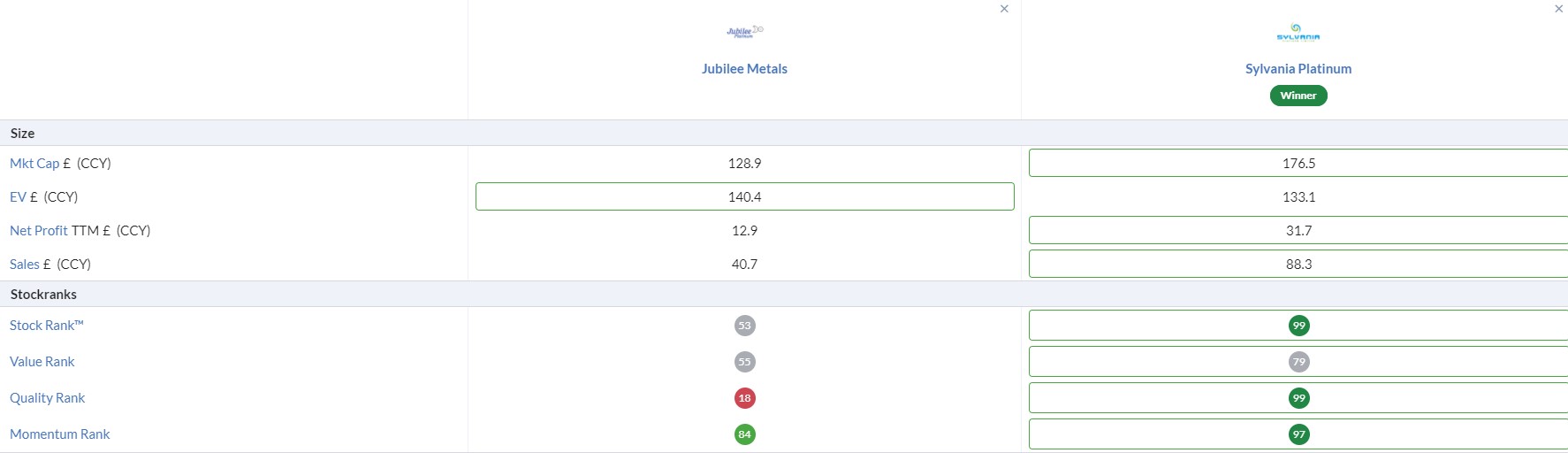

I know that a lot of Stocko readers like Sylvania Platinum Sylvania Platinum (LON:SLP) which is a £160m market capitalisation company that extracts Platinum Group Metals (“PGMs”) including platinum, palladium and rhodium from mine dumps. The shares in Sylvania Platinum (LON:SLP) were around 20p in January 2019, and are around 62p now. (I hold)

In November 2019, I noticed what might be called a mini-Sylvania called Jubilee Metals - Jubilee Metals (LON:JLP) – which had raised £6.49 million in an oversubscribed placing at 4p per share. The placing shares represented approximately 8% of the enlarged share capital, and Canaccord Genuity raised its stake from 5.6% to 12%. So I bought some too. The market cap is presently £115 million.

On 12th October 2020, the company issued an optimistic operational update for Q3 2020.

What does the company do?

JLP’s main projects are:

| Name | Location | Commodities and Status | Resource |

| Inyoni | South Africa | Platinum Group Metals (“PGMs”) and Chrome In production | Rights to 4.7Mt (million tonnes) of chrome rich surface tailings and a further 1Mt of PGM rich material, currently recovering around 2,500 oz per month. |

| Windsor PGM | South Africa | PGMs and Chrome | 1.45Mt of PGM and chrome-rich material at surface on site |

| Kabwe | Zambia | Zinc, lead, vanadium, copper, cobalt | 91.5% owner of the Kabwe JV with access to 6.4Mt of surface material, plus acquisition of the Sable refinery. |

| Dilokong | South Africa | PGMs and Chrome In production | 850,000 tonnes of platinum and chrome-rich tailings at surface |

Recent Progress/Announcements

In May 2020, the company announced that it was relocating its chrome processing plant from Dilokong to its Windsor location, which was “expected to significantly enhance Jubilee’s chrome operational outputs.”

In June 2020, Jubilee announced “Project Elephant” - that it had secured 150Mt of copper…