The Tories want more people to get a start on the housing ladder and have promised they will build “at least” a million new homes over the next 5 years. New buyer incentives include life-time fixed rate interest mortgages with 5% deposit and a First Home scheme offering 30% discount to local 1st time buyers. Boris has gone further suggesting he could scrap stamp duty from properties worth less than £500K – Could this be included in the promised budget announcement within the first 100 days of a Conservative win?

Any additional government stimulus should be good news for housebuilders whose profits and dividends have been boosted by the (extended to 2023) Help to Buy scheme. Housebuilders share prices reacted accordingly on Friday with new highs, but could there be more to come?

It was Simon Thompson in the Investors Chronicle who some years ago identified that Housebuilders share prices typically increased in Q1 of the year, so it has normally paid to buy Housebuilders at the start of January and sell them again in the spring.

Arguably the Q1 Housebuilder effect has yet to come. I have a hunch that within the UK housebuilding sector it will be a case of, “a rising tide lifts all boats”, so rather than undertake individual company research I have created a profitability/momentum factor screen to do the selection for me:

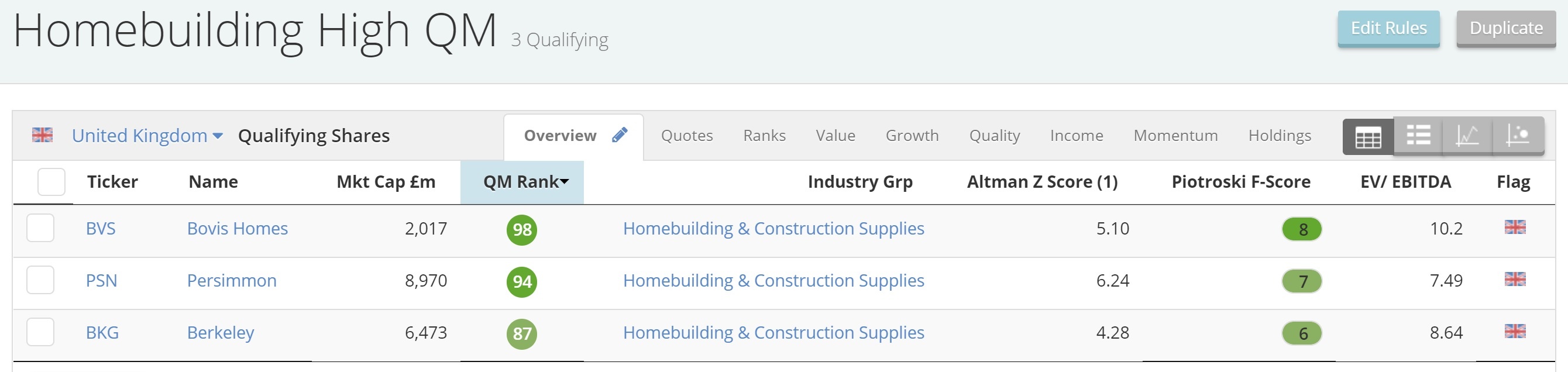

Rising Tide (High QM) Criteria:

Industry Group: Homebuilder and Construction Supplies (31 companies)

Mrk Cap >£150M (No small caps)

QM Rank >80 (Top 20% by Quality + Momentum score)

Z1 Score >3 (Low risk of Bankruptcy and strong Balance sheet)

F-Score >5 (Improving financial health)

EV/EBITDA <12 (Not too expensive)

Bovis Homes (LON:BVS) Persimmon (LON:PSN) and Berkeley Group (LON:BKG) jump the screening hurdles, so I have brought into all 3 this morning. At the end of March I plan to reallocate, hopefully for a significant gain. Time will tell. Ian